The pace of container port capacity expansion is forecasted to contract at least 40% over the next five years in the wake of the COVID-19 induced slowdown in port throughput, according to the latest Global Container Terminal Operators Annual Review and Forecast report published by global shipping consultancy Drewry.

Global container terminal capacity is projected to grow at an average annual rate of 2.1% over the next five years, equating to an additional 25 million TEUs a year, well below the capacity growth seen over the past decade, when the average annual increase was more than 40 million TEUs a year.

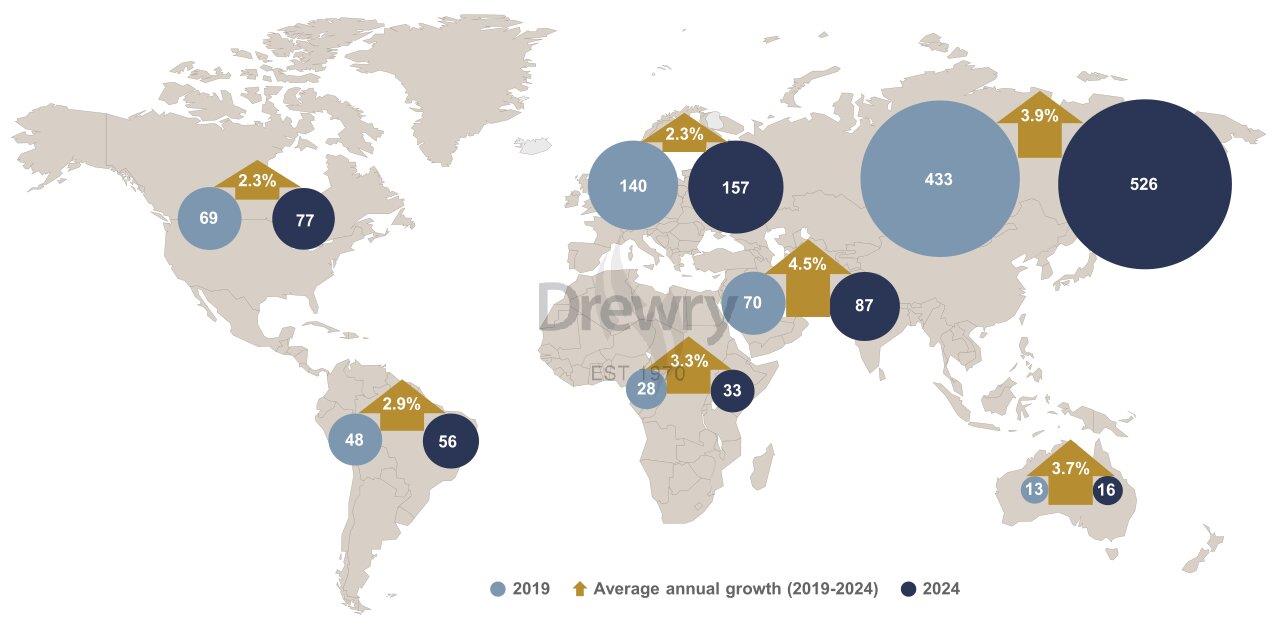

Port throughput is projected to grow at an average annual rate of 3.5% over this period from 801 million TEU in 2019 to reach 951 million TEU by 2024.

Drewry noted however that risks remain to this outlook should a resurgence in COVID-19 cases cause further widespread economic lockdowns over the forecast period.

“Our five-year forecast for global container port handling has been cut back drastically due to the COVID-19 pandemic, and the risks remain heavily weighted to the downside,” said Eleanor Hadland, author of the report and Drewry’s senior analyst for ports and terminals.

Delays in ongoing projects

As a result of the pandemic operators and port, authorities are actively reviewing the delivery of planned projects in the light of the drastic slowdown in economic growth and uncertain short-to-medium-term outlook.

“Major expansion projects and greenfield projects that are already under construction and due for commissioning in 2020 and 2021 may face minor delays due to interruptions to global supply chains during 1H20,” added Hadland.

“However, for projects which are currently at an earlier stage of planning, particularly where construction contracts and equipment orders have not yet been tendered, suspension or cancellation is more likely if market conditions remain poor.”

According to Drewry, in recent years global operators had already scaled back investment plans, with only limited greenfield projects in the pipeline. However, leading operators look set to continue to lead the way in terms of terminal automation.

Currently, more than three-quarters of automated terminals are operators by global and international operators, and of the 22 automated terminal projects currently planned (including both greenfield and brownfield), more than 80% will be delivered by this group of leading operators.

Looking back at 2019 performance, the group of 21 companies classified by Drewry as global/international terminal operators out-performed the market, with combined equity-adjusted volumes growing 4.3% compared to global growth in port throughput of 2.1%.

However, this headline figure disguises strongly divergent growth patterns. In 2019 six out of 21 global/international terminal operators reported lower volumes on an equity-adjusted basis.

“Divestment of non-core assets and the fall-out from the US-China trade war were key factors behind these results,” explained Hadland.

Top global/international terminal operators

Drewry said despite global throughput remaining flat, year-on-year PSA retained its top spot in Drewry’s rankings. By contrast, Hutchison Ports saw volumes fall by more than 2% and dropped back to fourth place.

DP World, with 2019 throughput only marginally above 2018 levels, also dropped a position. China Cosco Shipping and APM Terminals both reported strong growth in volumes, and both moved up the table to take second and third place respectively.