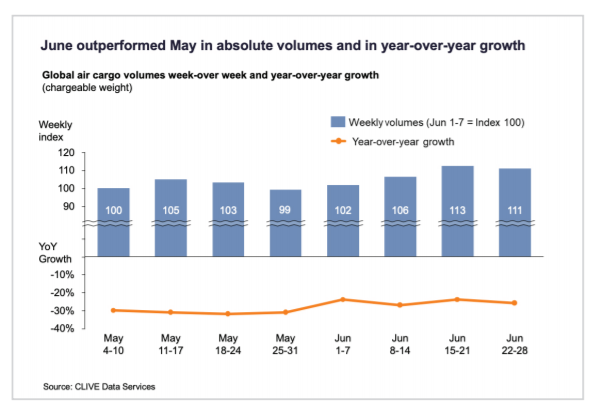

Airfreight market analyst, CLIVE Data Services, said the air freight industry seems to be ‘slowly getting back up on its feet’ as volumes in June was 6% up compared to May.

“As PPE volumes faded, global air cargo volumes in June provided the first real indicators of structural recovery,” CLIVE said in a July 2 report.

The latest air cargo market analyses by CLIVE Data Services also showed volumes in

the last week of June was 12% higher than in the final week of May.

The year-on-year performance gap ‘further closed’ according to CLIVE, with global volumes down 25% versus June 2019. Global airfreight volumes in May 2020 were 31% lower than in May last year.

The available capacity in June ‘remained flat,’ but the last two weeks of June saw capacity creeping up slowly week-over-week by around 1.5% per week.

Meanwhile, CLIVE’s ‘dynamic load factor’ of 71% in June – based on both the volume and weight perspectives of cargo flown and capacity available – recorded its highest level since CLIVE began measuring the industry’s weekly performance in 2018.

Managing Director, Niall van de Wouw, says CLIVE’s latest analyses will help address industry concerns over the distorted state of the air cargo market.

“As governments around the world acted to protect their societies, they became unlikely (price-insensitive) customers of international air cargo capacity for urgent supplies of PPE. While our data for May and now June has shown month-on-month improvements, and airlines have been reporting peak weeks and months for cargo, the big question has been ‘what happens when PPE volumes dry up?”

Structural market recovery

“Our June analyses seem to suggest the first steps towards a structural market recovery,” said van de Wouw.

“Despite the decreasing demand for PPE in June, we still see that the volumes increased over May. We are starting to see a more recognisable airfreight market following more logical economic principles and more logical rates. The dynamic load factor in June was at a level we did not even see during normal peak Christmas periods, resulting in yields that are still well above the 2019 levels.” he added.

Whether returning general air cargo volumes are a consequence of lower airfreight rates or production starting up again, he says, only time will tell.

“In July, we would traditionally expect to see an influx of belly capacity for the summer holiday season, but that’s not there at the moment. The next test will be how an influx of ‘normal’ passenger flights, which are not driven by cargo demand, will impact dynamic load factor.”