The first half of the year largely turned out to be a resilient six months for the Asia-Pacific warehouse markets with most of the region under some form lockdown and with movement restrictions in place, according to Knight Frank, an independent global property consultancy firm.

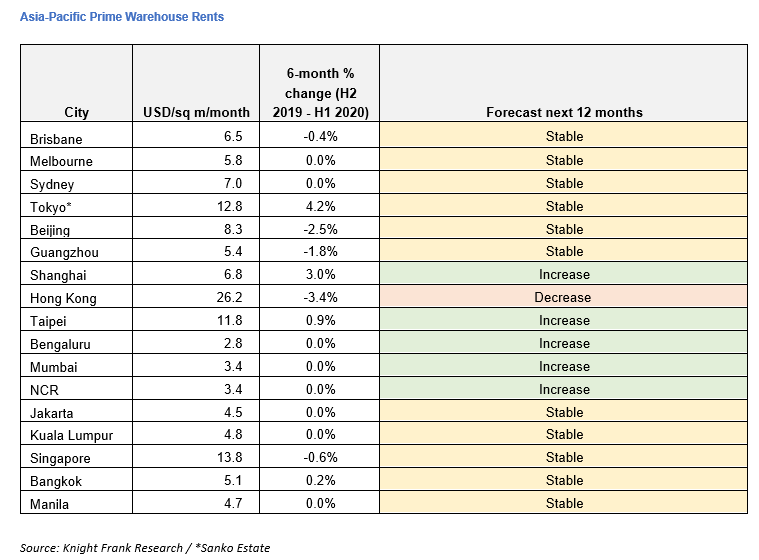

In its Asia-Pacific Warehouse Review, which tracked prime warehouse rents across 17 key cities in the region, the firm said an average change of just -0.02% half-on-half was recorded despite COVID-19.

Warehouse rent to increase 3%-5% by end 2020

In its review, Knight Frank said market conditions for 16 of the 17 cities tracked are expected to “remain stable or improve” over the next 12 months.

It added that the positive outlook for growth in the second half of 2020 is due to higher space appetite from e-commerce players and essential commodities.

Knight Frank said Tokyo recorded the highest half-on half rental growth at 4.2%, due to healthy take-up rates and the lack of available prime assets within the city.

Shanghai warehouse markets, meanwhile, recorded the healthiest rental growth compared to Beijing and Guangzhou, at 3% half-on-half, led in part by a pickup in storage demand from cold chain operators.

“The outlook for industrial markets remains resilient due to robust demand from the e-commerce and essential goods sectors, as well as additional requirements for inventory storage to mitigate supply chain disconnects,” said Tim Armstrong, head of occupier services & commercial agency, Asia Pacific at Knight Frank.

Going forward, Knight Frank expects average rental growth between 3% to 5% by the end of 2020.