Chinese shipyards saw a sharp decline in market share over the past six months amid rising concern over proposed U.S. port fees targeting vessels built in China.

The planned fees, aimed at vessels constructed or ordered from Chinese yards—even if part of mixed-origin fleets—reflect U.S. efforts to bolster domestic shipbuilding and curb China's industry dominance.

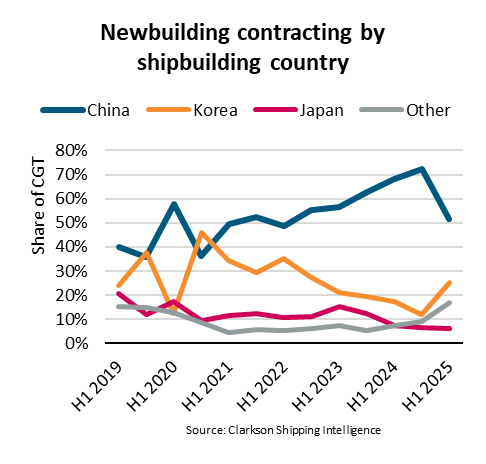

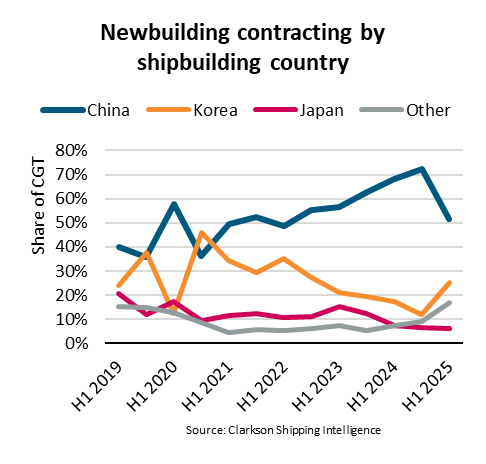

BIMCO, one of the largest of the international shipping associations representing shipowners, said in the first half of 2025, China's share of newbuilding contracting fell to 52% from 72% in the previous six months.

Filipe Gouveia, shipping analysis manager at BIMCO, said, "Growing concerns over USTR port fees on Chinese ships in US ports likely contributed to a decrease in contracting in China."

"This trend was further amplified by a drop in global ship contracting and a shift in the types of ships being ordered," he added.

BIMCO noted that U.S. Trade Representative (USTR) port fees, set to take effect in October 2025, will impact both Chinese owners and operators, as well as ships built in China.

Smaller Chinese-built ships will be exempted from fees, depending on sector-specific criteria, along with exemptions for short-haul voyages.

Global newbuilding contracting in terms of Compensated Gross Tonnage (CGT) dropped 54% year-on-year (y/y) during the first half of 2025.

Contracting slowed significantly for bulkers, tankers, and gas carriers amid weaker freight rates. Container and cruise ships were the only large sectors where contracting expanded.

BIMCO said China holds a leading position in the global shipbuilding industry, absent only from the cruise ship sector. In 2024, gas carriers were the only sector where China came second to South Korea.

However, so far this year, South Korea has also surpassed China in crude tanker shipbuilding.

"Even if shipowners try to avoid ordering ships in China due to USTR fees, there is a limit to the capacity available outside of the country. Consequently, if global ship contracting had not significantly dropped during the start of the year, China's share of contracting would have likely been larger," Gouveia said.

The constraint in shipbuilding capacity has already led to a large orderbook with long lead times, especially for larger ships and for container ships, gas carriers, and cruise ships.

BIMCO noted that out of this year's contracting, 31% are expected to be delivered in 2027, 38% in 2028, and 23% thereafter.

South Korea and Japan are the second and third largest shipbuilding nations; however they face challenges in expanding their production capacity. Both nations are experiencing labour shortages due to declining populations. This has led to higher labour costs, affecting their competitiveness.

"China's dominant position in shipbuilding is unlikely to significantly change soon, but the country could face increasing competition in the medium term. Countries like the Philippines and Vietnam, already small-scale producers of bulkers and tankers, may boost their output, benefiting from low labour costs," Gouveia said.

"Meanwhile, although the US and India currently have limited shipbuilding capacity, both governments are actively working to strengthen their domestic industries. However, even if they succeed, it will take time for them to scale up production," the BIMCO shipping analysis manager, added.

The USTR is set to impose fees on all Chinese-built and -owned ships docking at U.S. ports, calculated based on net tonnage or cargo carried per voyage.

The new tax will take effect on October 14, and will impose a fee of US$50 per net ton on Chinese-built and -owned ships, with the rate increasing by US$30 annually over the next three years.

Chinese-built ships owned by non-Chinese companies will face a fee of US$18 per net ton, with annual increases of US$5 over the same three-year period. Ocean carriers providing proof of an order for a U.S.-built vessel will have the tax suspended for up to three years.

The latest announcement scales back earlier February proposals to impose fees of up to US$1.5 million per port call on China-built ships, which had triggered significant backlash from the industry.