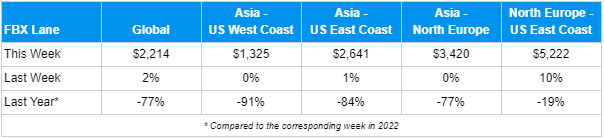

Transpacific ocean rates to the US West Coast were level this week and well below January 2019 levels alongside new reports of slowing US consumer spending on goods.

In its latest analysis, Freightos said import volumes handled by East Coast ports remain higher than in 2019 due to the eastward shift of containers that began last year to avoid potential West Coast port labour disruptions – with new reports of small-scale actions by union members in the last few weeks.

But despite relatively strong volumes, Asia- US East Coast rates are well below 2019 levels too.

It added that Asia-North Europe prices were stable this week as well. And while there are signs of an economic rebound, import demand remains subdued.

"In response to falling volumes, carriers are continuing to cancel sailings out of Asia and are taking other steps like slowing vessel speeds and taking longer routes to try and bring capacity down to the current levels of demand," said Judah Levine, head of research, Freightos Group.

"They are also expected to increase the number of older ships that will be scrapped this year."

Source: Freightos

Levine noted, though, that projection that 2023 ex-Asia volume totals will only be slightly below 2022 implies expectations for a rebound in demand later this year.

The report said the Transatlantic trade, though, remains an "anomaly."

It said North Europe-US East Coast rates ticked up 10% this week and – despite being 19% lower than a year ago – at US$5,222/FEU are still nearly 4X their level in 2019.

Meanwhile, demand did begin to ease in November, but volumes were still 20% higher than in 2019.

"And as opposed to ex-Asia lanes where blanked sailings are climbing, carriers have continued to add capacity to this lane. CMA CGM even announced a Peak Season Surcharge for transatlantic volumes this week, indicating that demand has remained strong into 2023," Levine added.