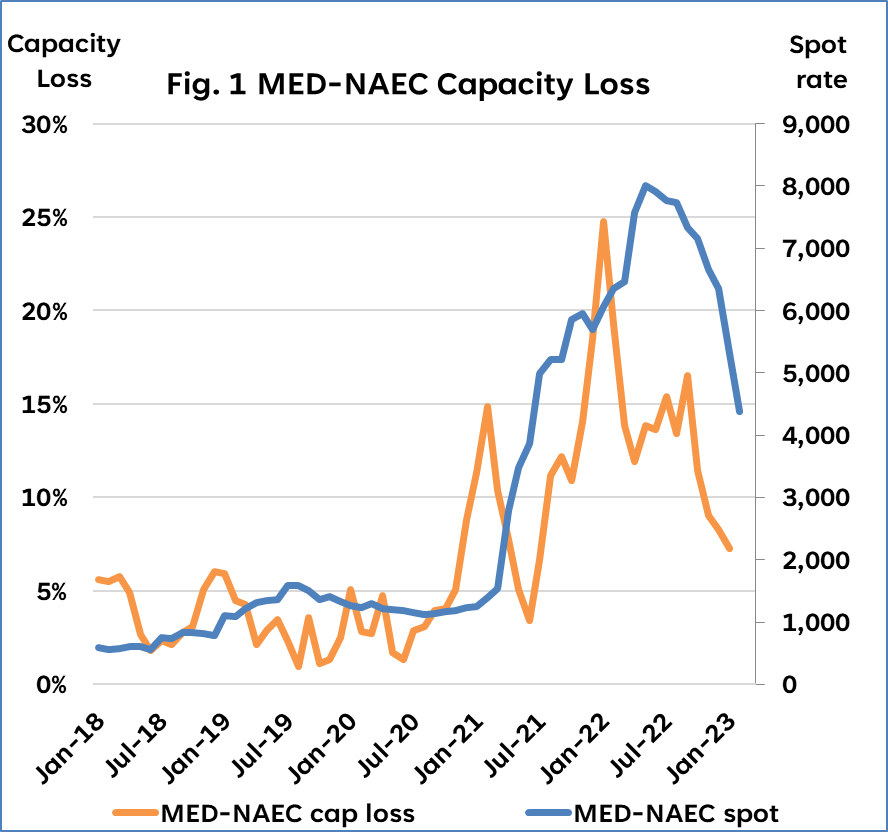

Maritime analysts at Sea Intelligence have noted that a reversal of capacity loss has been observed over the past year as vessel congestion started to ease.

In its latest analysis, Sea-Intelligence said while the pandemic challenges were initiated by an exceptionally large growth in demand, the real challenge came as this high demand growth clogged up the hinterlands, which in turn clogged up the ports, which in turn led to unprecedented levels of vessel congestion.

"When vessels don't move, they do not contribute to deployed capacity, and the capacity of the non-sailing vessels effectively becomes a loss of supply," said Alan Murphy, CEO, Sea-Intelligence, adding that this loss of supply became a greater factor in the supply/demand imbalance than the demand growth that initiated it.

"On a global level, however, we have seen a reversal of capacity loss over the past year as vessel congestion has eased," Murphy said.

The Sea Intelligence report noted that with the latest measure of 6.2% capacity loss in January 2023, the market is now "roughly 2/3" of the way back to the normality of 2.2% from the peak in January 2022.

"In the last two months, though, we have seen a reversal, i.e., an increase in capacity loss. However, this could very well be a seasonal impact of inclement weather," Murphy said.

Source: Sea-Intelligence