Global decline in container demand abated sharply in March 2023 on most major trade lanes, with a significant exception of US imports from Asia, according to a recent analysis by Sea-Intelligence.

The provider of Research & Analysis, Data Services, and Advisory Services within the global supply chain industry said the US-Asia lane has now continually dropped at a pace fluctuating around -20% year-on-year, which it noted has often been explained by US inventory correction.

"However, from the point of view of sales, data from the US Census Bureau clearly shows that the process of clearing inventories is not progressing rapidly," analysts at Sea Intelligence said.

It noted that since inflation impacts both sales and inventories, an inventory-to-sales ratio is unaffected by inflation.

"The data shows that for manufacturers, the size of inventories has stagnated and certainly not decreasing. On the other hand, retailers and wholesalers are seeing an increasing trend. This means that the size of inventories relative to sales continues to increase. If any underlying inventory correction occurs, it is clearly insufficient," commented Alan Murphy, Sea-Intelligence CEO.

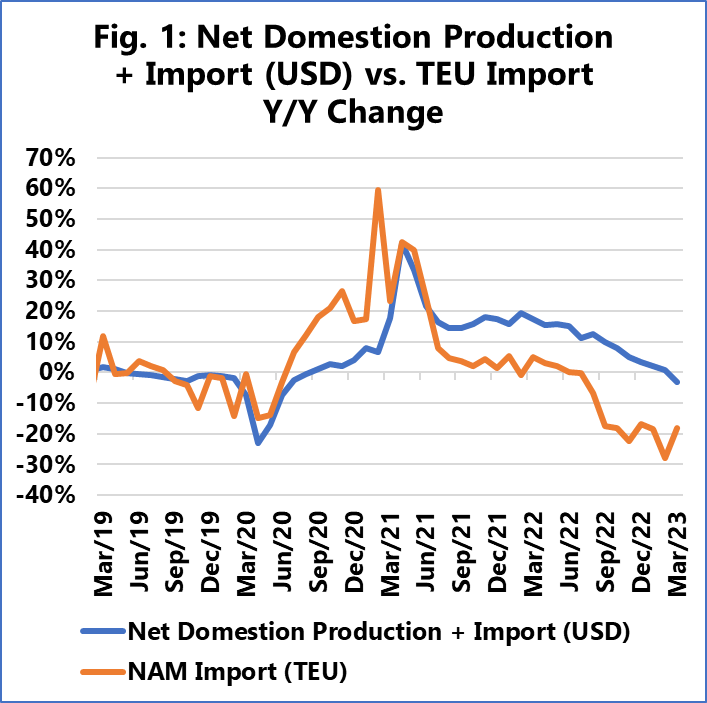

"If we sum monthly total sales and the monthly net change in total inventories, it should equal the value of imports + domestic production. Assuming that domestic production is a relatively stable small share, we would expect a strong correlation to volume imports," he added.

Source: Sea-Intelligence

The Sea Intelligence report noted a clear correlation pre-pandemic, whereas US$ imports lagged behind during the pandemic, as shown in Figure 1.

"The sharp drop in TEU imports after that is not reflected to the same degree in the value of imports," the report said.

It added that part of the disconnect may be owing to the contraction of the supply chain; however, the supply chain is now rapidly approaching normalisation.

It added that one alternative explanation is a normalisation of consumer spending habits.

Murphy explained that the boom in US imports in 2020-2021 was to some degree driven by consumers shifting spending away from services and over onto goods, which also increases container volumes.

"A reversal of this spending behaviour will mean a negative impact on container volumes for quite a while longer — and consequently, the upcoming peak season 2023 might turn out not to be present," the Sea Intelligence chief said.