After two very profitable years for the shipping lines, the market is shifting into "post-pandemic normality," according to a new Sea-Intelligence report.

"While 2022-Q4 gave us a first glimpse into what this might look like, 2023-Q1 was the first quarter where the carriers' operating profits took a real hit," the Danish maritime data analysis firm said.

"This continued into 2023 Q2, with the combined EBIT dropping by -90% Y/Y (year-on-year) to a little over US$3 billion," it added.

Further to that, Sea-Intelligence noted that both ZIM and Wan Hai once again recorded an operating loss.

It added that while ZIM has had profitability issues in past Q2's, this was a first for Wan Hai in 2012-2023.

[Source: Sea-Intelligence]

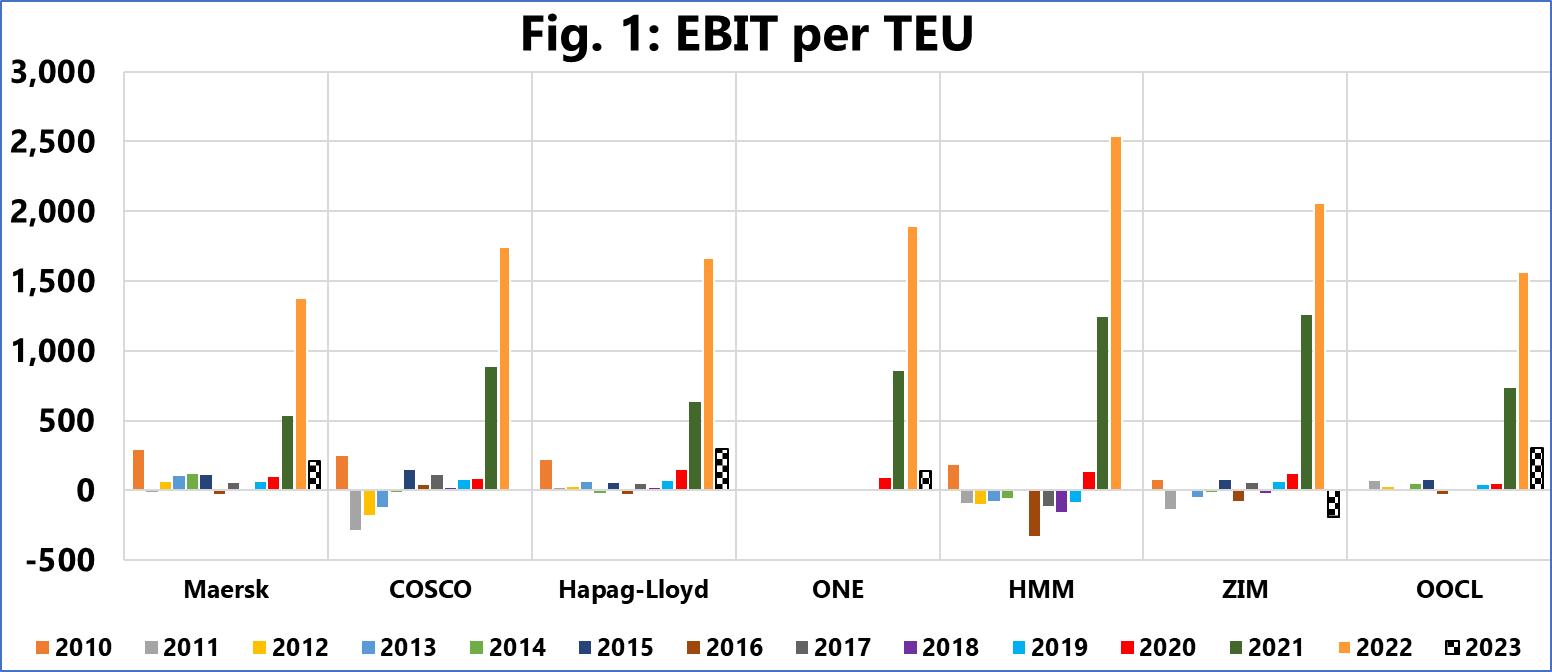

"Figure 1 shows the EBIT/TEU of the shipping lines that publish both their EBIT and their global transported volumes," commented Alan Murphy, CEO of Sea-Intelligence.

He added that none of these shipping lines were able to sustain their EBIT/TEU figures in 2023, with the largest Q2 2023 EBIT/TEU recorded by OOCL of US$305/TEU. In contrast, the smallest EBIT/TEU in Q2 2022 was US$1,377/TEU.

The report revealed that Maersk (US$207/TEU), Hapag-Lloyd (US$298/TEU), and ONE (US$137/TEU) all recorded EBIT/TEU within a much narrower range of US$130-300/TEU.

Meanwhile, Sea-Intelligence pointed out that in all of this, ZIM recorded a negative EBIT/TEU of -US$195/TEU.

"Basically, they lost US$195 for every TEU that they moved in 2023-Q2," the report added.

Sea-Intelligence said a large reason for the decline in profitability is the decrease in the freight rates, which dropped by -48% to -67% across the shipping lines that publish these figures.

"Another reason is the decline in transported volumes."

"What is surprising, however, is that ZIM, one of the only two shipping lines to record an EBIT loss, grew their volumes by 0.5% globally and by roughly 13% on both Transpacific and Asia-Europe," the report added.