Airlines in the Asia-Pacific region reported continued air cargo growth in March, fueled by frontloading ahead of upcoming tariff measures.

However, the region's air freight market is set to face subdued demand in the coming months as the US tariff measures are set to bite and hit most export-oriented countries in the Asia Pacific.

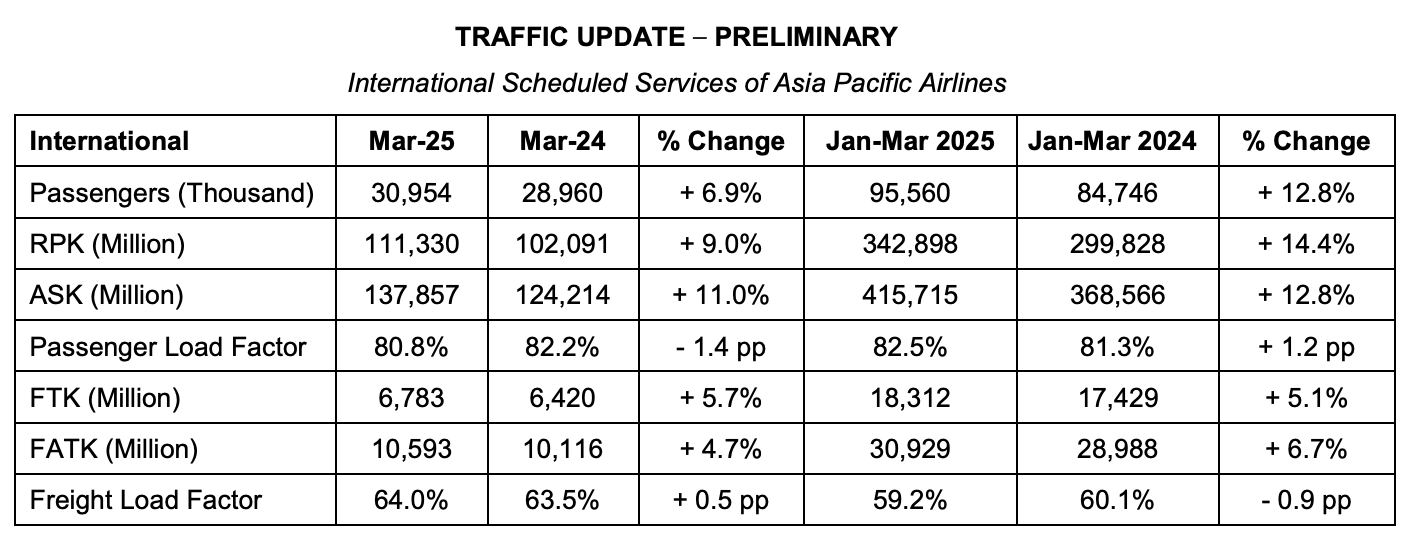

Traffic figures released by the Kuala Lumpur-based Association of Asia Pacific Airlines (AAPA) showed that international air cargo demand — measured in freight tonne-kilometres (FTK) — was up 5.7% year-on-year in March.

AAPA said the growth was supported by forward demand in shipments ahead of the potential imposition of tariffs.

March performance was also stronger than the 2.8% year-on-year growth recorded in February and the 4.7% year-on-year growth seen at the start of 2025 in January.

Offered freight capacity expanded by 4.7%, leading to a marginal 0.5 percentage point rise in the average international freight load factor to 64% for the month.

[Source: AAPA]

"On the cargo front, demand rose by 5% year-on-year in the first quarter, extending the solid 15% annual growth achieved in 2024," said Subhas Menon, AAPA director general.

"Anticipation of US tariff announcements prompted front-loading of air shipments on selected routes, while robust e-commerce activity continued to support overall demand," he added.

Looking ahead, Menon said, "The sweeping U.S. tariff announcements have resulted in volatile activity across the world's stock markets, casting uncertainty over the outlook for Asia's export-oriented economies, many of which serve as major manufacturing hubs."

"This could weigh on consumer and business sentiment, potentially softening passenger and cargo demand in the coming months," he said.

In addition, he noted that operational challenges resulting from persistent supply chain issues, including aircraft delivery delays, continue to constrain capacity expansion.

"As a result, airlines face elevated operating costs, including high maintenance, leasing and personnel expenses. In response, Asia Pacific carriers remain focused on driving cost efficiencies, whilst continuing to expand their networks and pursue customer service innovation," Menon said.