Global air cargo continued to grow in May, showing resilience despite shifting trade policies and ongoing geopolitical disruptions.

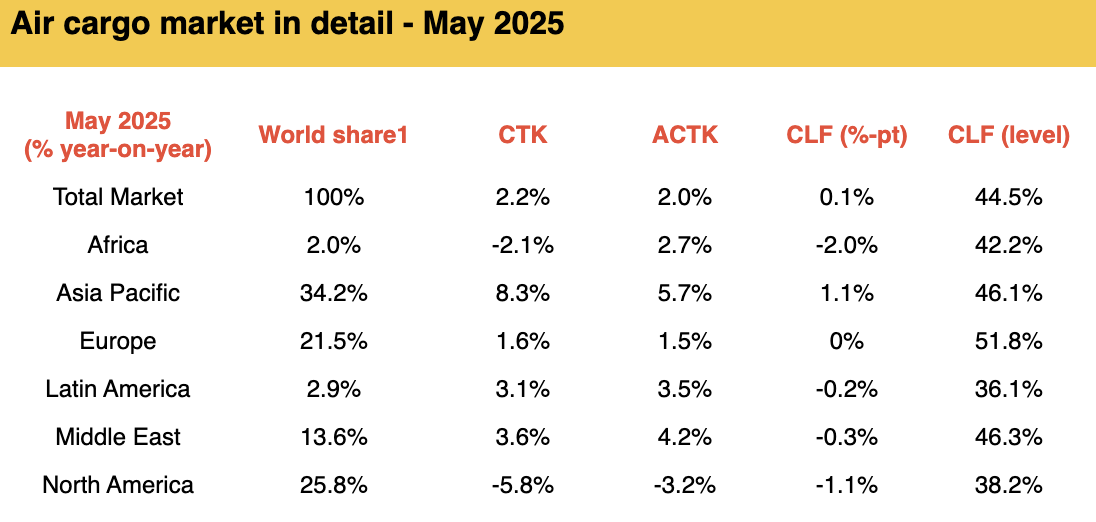

The International Air Transport Association (IATA) released data for May 2025 global air cargo markets showing total demand, measured in cargo tonne-kilometers (CTK), rose by 2.2% compared to May 2024 levels, and up 3.0% for international operations.

Capacity, measured in available cargo tonne-kilometers (ACTK), increased by 2.0% compared to the same period in 2024, on the back of a 2.6% increase for international operations.

"Encouraging" May cargo numbers

"Air cargo demand globally grew 2.2% in May. That is encouraging news, as a 10.7% drop in traffic on the Asia to North America trade lane illustrated the dampening effect of shifting US trade policies," said Willie Walsh, director general of IATA.

"Even as these policies evolve, already we can see the air cargo sector's well-tested resilience helping shippers to accommodate supply chain needs to flexibly hold back, re-route or accelerate deliveries," the IATA chief added.

[Source: IATA]

Most of the world's airlines saw year-on-year cargo demand growth in April, except carriers in North America and Africa, which saw decreases of 5.8% in growth for air cargo in May — the slowest growth of all regions — and African airlines, which saw a 2.1% decline in demand for air cargo in May.

Asia-Pacific airlines led the growth, showing an 8.3% year-on-year demand expansion for air cargo in May, the strongest growth of all regions, as capacity increased by 5.7% year-on-year.

Latin American carriers reported a 3.1% increase in demand growth for air cargo in May, with capacity expanding by 3.5% year-on-year. Middle Eastern carriers registered a 3.6% growth in demand for air cargo in May as capacity grew by 4.2% compared to the same period in 2024.

European carriers saw 1.6% year-on-year demand growth for air cargo in May. Capacity increased 1.5% year-on-year.

[Source: IATA]

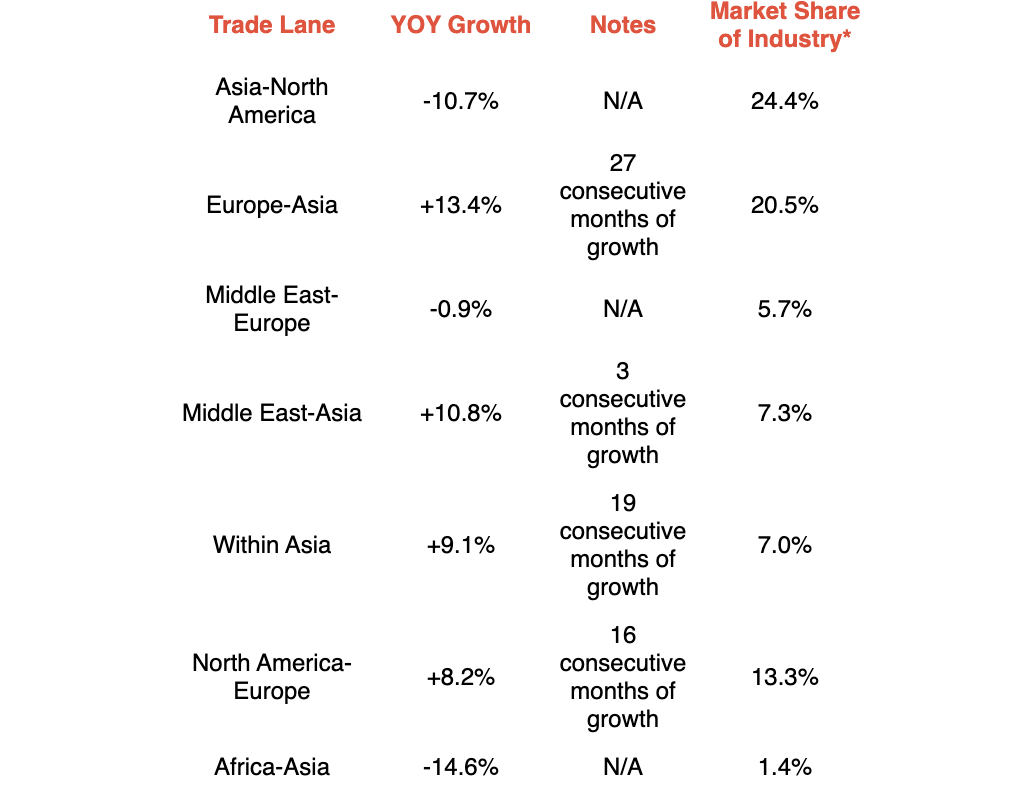

IATA said in terms of trade lane growth, a significant decrease in the Asia-North America trade lane was expected and realized as the effect of front-loading faded (moving goods to market in advance of tariffs coming into effect) and changes to the de-minimis exemption on small package shipments (particularly those associated with e-commerce) were enforced.

It noted, however, that as cargo flows reorganized, several route areas responded with "surprising growth."