Despite signs of a slowdown heading into Q4, global air cargo demand is still expected to grow 3-4% year-on-year in 2025, according to a new analysis from Xeneta.

The rate benchmarking and market intelligence firm said summer volumes exceeded expectations, but September data pointed to cooling momentum amid ongoing trade uncertainty. Still, the outlook is "not as bad as feared" for airlines and forwarders.

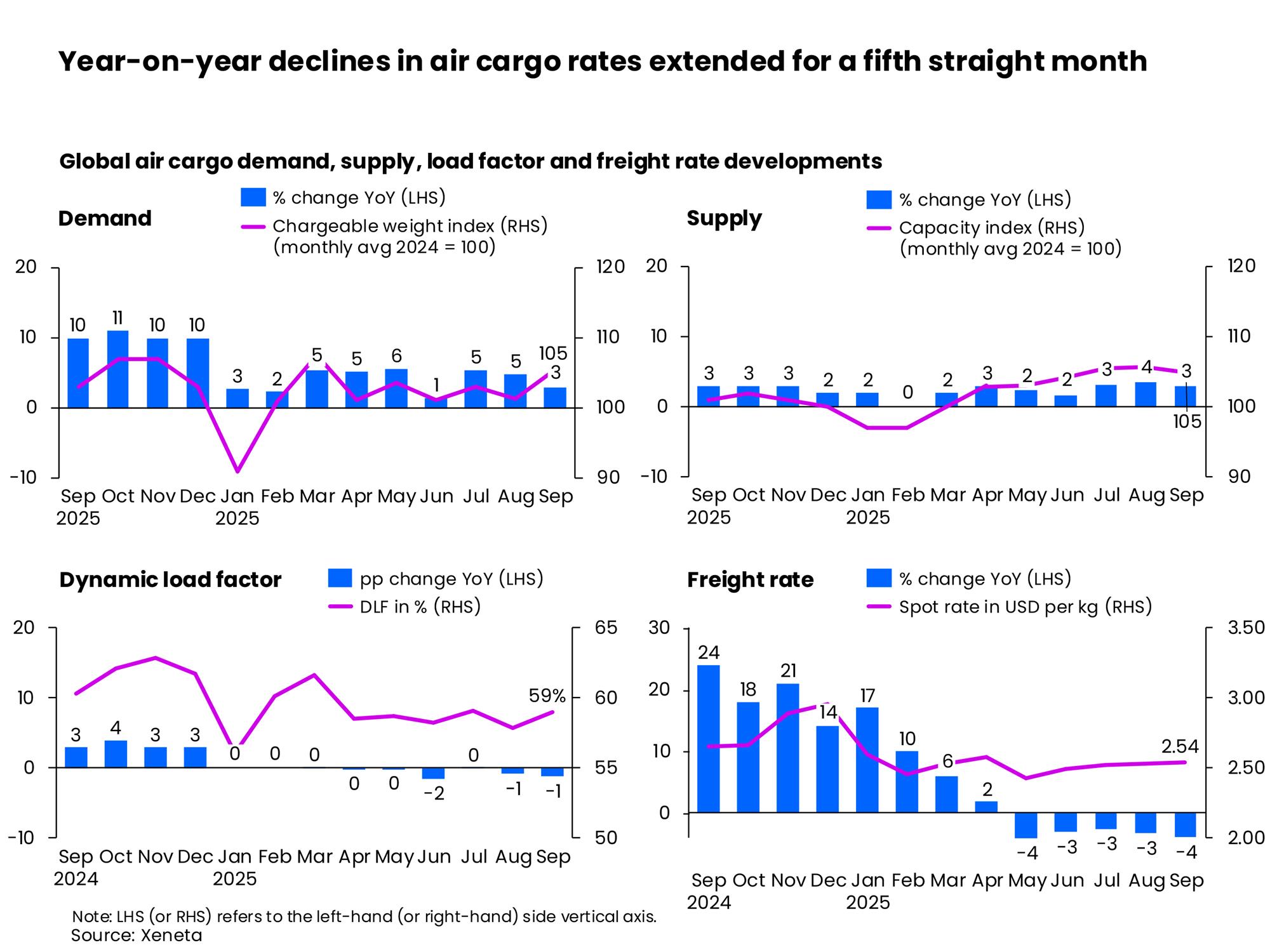

"At what would traditionally be seen as the commencement of the peak season for air cargo volumes, demand growth slowed to 3% year-on-year — on a par with growth in capacity — in September following consecutive 5% year-on-year increases in July and August," Xeneta said.

Month-on-month, it noted that volumes also saw a lower 3% rise.

"Over the previous two months we've seen how air cargo has gained from 'piggybacking' on global uncertainty, whether that's frontloading supply chains or modal shift from ocean to air to move goods more quickly before tariffs took hold," said Niall van de Wouw, chief airfreight officer at Xeneta.

"September's data is an early indication that this is lessening as some stability starts to return on major corridors and everything is less hectic on a global level."

Slower growth squeezes yields

The slowdown of volume growth also continued to squeeze yields. Air cargo spot rates registered a fifth consecutive month of year-on-year declines in September, falling by 4% to a global average of US$2.54 per kg.

Xeneta noted that much of the downward pressure came from muted activity on Transatlantic and Transpacific routes, where repeated extensions of US tariff deadlines appear to have pulled forward volumes into the summer months.

The US administration's decision to remove the 'de minimis' threshold for low value cross-border shipments also caused Chinese e-commerce exports to the US to fall for a fourth consecutive month in August.

Sales of low-value and e-commerce goods slumped 38% year-on-year, according to the latest China Customs’ data.

E-commerce boosts Asia-Europe demand

Meanwhile, growing e-commerce volumes, a result of the Chinese e-commerce behemoths shifting their focus towards European consumers, helped to push volumes 4% higher on the Asia–Europe corridor in the first three weeks of September compared to the previous month.

Demand was also supported by the pre–Golden Week cargo rush as well as mode shift due to the suspension of China–Europe rail links at the Polish border.

China Customs reported year-to-date cross-border e-commerce and low-value goods sales to Europe increased 58% year-on-year, with August alone up 55%.

van de Wouw says it is 'astonishing' how quickly China's big e-commerce players have been able to pivot towards Europe to boost their growth since the US' decision on de minimis.

In terms of the latest 100% pharmaceutical tariffs imposed by the US government, effective from October 1, the impact will likely be more measured due to earlier negotiated agreements with the EU and Japan.

The UK also negotiated a trade agreement with the US, but the tariff rate for pharmaceuticals remains pending.

Additionally, the US focus on branded or patented products shields most of India's pharma exports, which fall under low-cost generic medicines.

Even so, Xeneta said the overall Asia-Europe growth in September compared to August remains well below last year's 9% surge.

Super Typhoon Ragasa added to the gloom. The storm disrupted East Asian hubs in the final week of September, leaving monthly volumes up by only 3% on August.

US tariffs' profound impact on seasonal flows

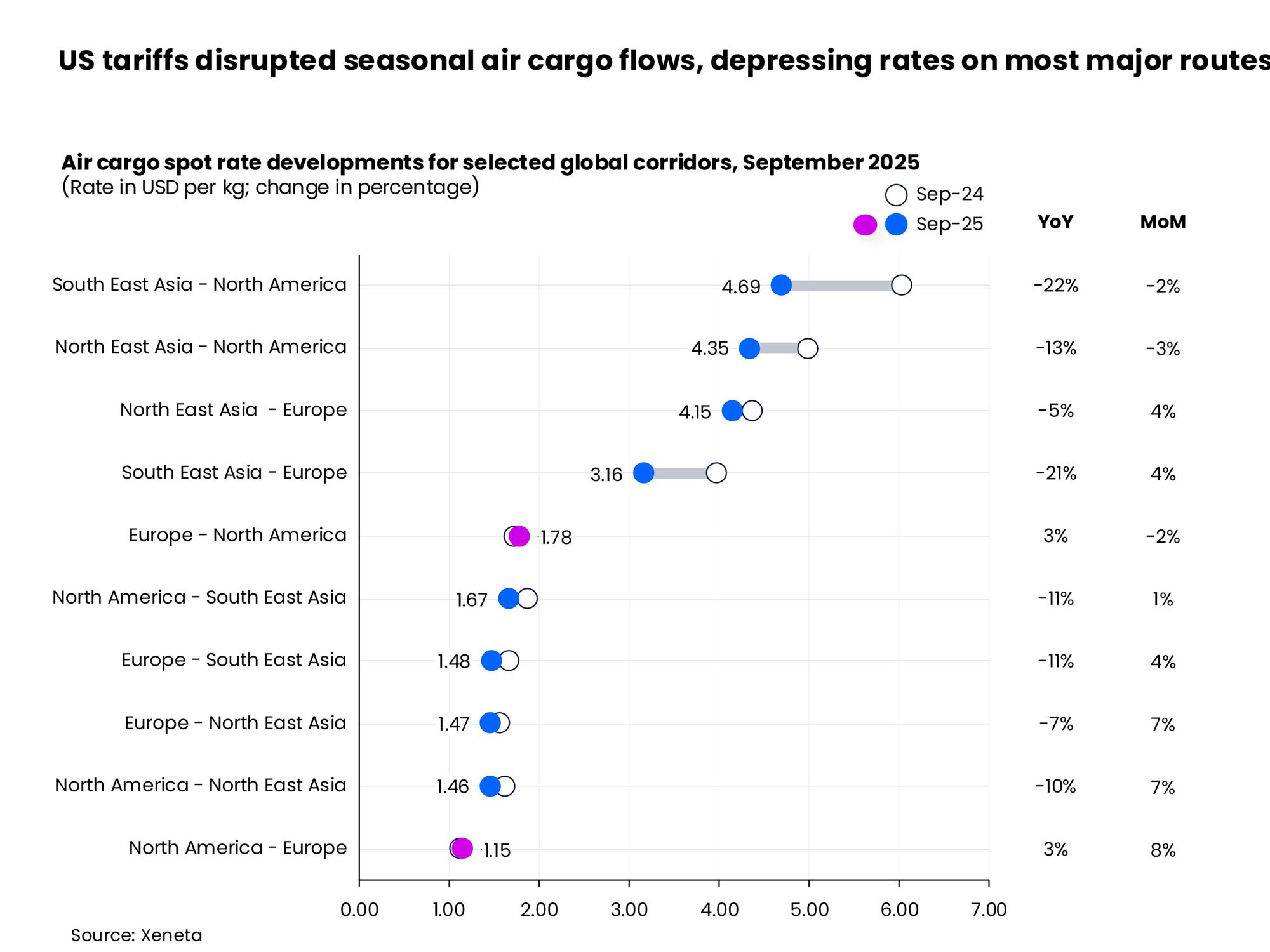

"At the corridor level, the US tariffs have created profound impacts on seasonal air cargo flows," van de Wouw said.

Across both the Transpacific and Transatlantic markets, the average air cargo spot rates slipped by 2-3% in September compared to a month ago.

Even as supply chains shift towards the Southeast Asia market for production to lessen the impact of tariffs, September's Southeast Asia to the US spot rates failed to grow, declining 2% month-on-month and a striking 22% compared to a year ago.

The reduction of e-commerce volumes due to US global 'de minimis' bans left a gaping hole in the Transpacific market, marked by carriers’ agility in shifting freighter capacity away from the region.

Reflecting the general slowdown in growth, Europe to the US air cargo markets also saw lower volumes as the earlier frontloading due to extended US tariff deadlines disrupted traditional seasonal flows.

On a more positive note, September air cargo spot rates on the westbound and eastbound legs remained higher than a year earlier.

About a 20% reduction in Transatlantic capacity in late October at the start of airlines' winter schedules, when passenger belly capacity is taken out after the summer months, is expected to reverse freight rate declines, but is, van de Wouw, says "a consequence of supply, not demand".

Asia-to-Europe trade lanes offered a little more cheer as September spot rates from Northeast and Southeast Asia to Europe edged up by 4% month-on-month, supported by the run-up to the peak shipping season. Compared with a year ago, however, they were down 5% and 21% respectively.

Shippers and forwarders remain wary

The level of rate fluctuation is creating a "wary mood" for contract negotiations between shippers and freight forwarders.

Xeneta said in its analysis that the share of six-month deals rose by nearly ten percentage points year-on-year to 22% in the third quarter, timed to expire just after the peak season and ahead of the next annual cycle. By contrast, the share of contracts lasting more than a year has fallen, reflecting doubts about the longer-term outlook.

"There is such limited bandwidth for shippers. They are looking for stability at a reasonable, competitive rate, and want to go long on contract negotiations preferably, because it's such a painful process for them trying to plan on a quarter-by-quarter basis," van de Wouw said.

Looking at the outlook for Q4, van de Wouw said "2025 not as bad as feared."

“When we reported better-than-expected demand in July and August, our question was 'how long will it last?'. In September, we started to see the market growth slowing, and we expect this to continue for the rest of the year," he said.

Based on current market fundamentals, he now expects 2025 to end with a 3-4% growth in air cargo demand.

"Q4 for airlines and freight forwarders will likely not be as good as hoped, but 2025 overall may not be as bad as they feared. A year ago, at this time, we talked of a 'peak season to be proud of' and air cargo on its final approach to double-digit growth. One year down the line, the market looks very different," the Xeneta chief airfreight officer said.