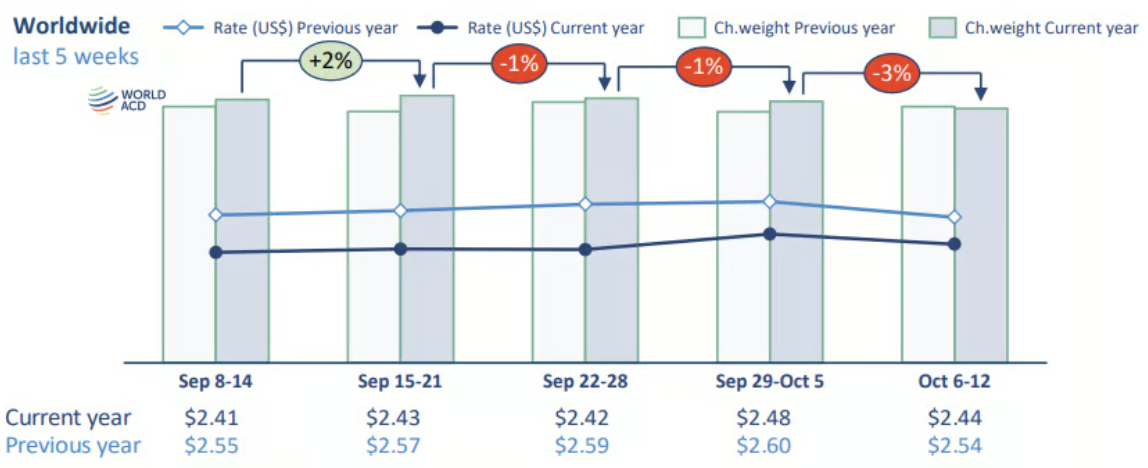

Global air cargo volumes fell 3% during the week of Oct. 6–12, largely due to holiday slowdowns in China, Taiwan and South Korea, following a brief recovery in shipments from Hong Kong and southeast China after super-typhoon Ragasa.

Asia Pacific air cargo volumes fell 9% week-over-week in week 41, according to WorldACD Market Data, with China and Hong Kong down 13% and 6%, respectively, amid an extended Golden Week holiday from Oct. 1–8. Taiwan saw a 10% decline tied to its National Day celebrations, while South Korea's chargeable weight dropped 46% due to the combined impact of Chuseok (Oct. 5–8) and Hangeul Day (Oct. 9).

Excluding the impact of regional holiday disruptions, global air cargo volumes would have posted a modest 1% week-over-week increase in week 41, according to WorldACD's analysis of more than 500,000 weekly transactions.

[Source: WorldACD]

Combined global air cargo volumes for weeks 40 and 41 were up 4% year-over-year, despite an extended Chinese holiday. Shipments from Asia Pacific to the U.S. fell 11% week-over-week, slightly more than the 9% drop in demand to Europe.

Chargeable weight from China to the U.S. also declined 11% in week 41, putting it 6% below last year’s level.

Further fall in China to US spot rates

On the pricing side, one noticeable change was that air cargo spot rates from China to the U.S. fell for the second consecutive week by 7%, WoW, to US$4.07 per kilo – taking them 20% below their equivalent level in week 41 last year, when spot prices had already started bouncing back from their subdued level the previous week during Golden Week.

But tonnages and spot rates from Hong Kong to the U.S. were more stable, with spot rates down just 1%, WoW and 2% higher, year on year (YoY) – despite tonnages being 19% lower than their equivalent level this time last year, due to reduced e-commerce volumes since the removal of 'de minimis' exemptions on low-value U.S. imports.

"The threat of new higher U.S. import tariffs on goods from China from next month may lead to a spike in shipments and pricing as importers attempt to front-load cargo ahead of those tariff increases," WorldACD said.

"But there was no sign yet in week 41 (Oct 6-12) of any spike in either demand or rates for shipments from China and Hong Kong to the USA, with the threat only emerging on 10 October – in response to restrictions by China on its 'rare-earth' exports," it said.

Nonetheless, higher U.S. tariffs on goods from India to the U.S. seem to be having an impact on India exports, as tonnages ex-India to the U.S. dropped for the second week in a row, falling 4%, WoW, in week 41, while volumes ex-India to Europe increased 6%.