Worldwide air cargo tonnages are on track for 4% full-year growth in 2025, after chargeable weight in October recorded another 4% year-on-year (YoY) increase, driven by 9% YoY growth from Asia Pacific origins, according to the latest figures from WorldACD Market Data.

A new WorldACD analysis indicates that for the first 10 months of 2025, average worldwide air cargo tonnages were 4% higher than in the equivalent months last year, with Asia Pacific origins recording a 7% YoY increase for the year to date (YtD).

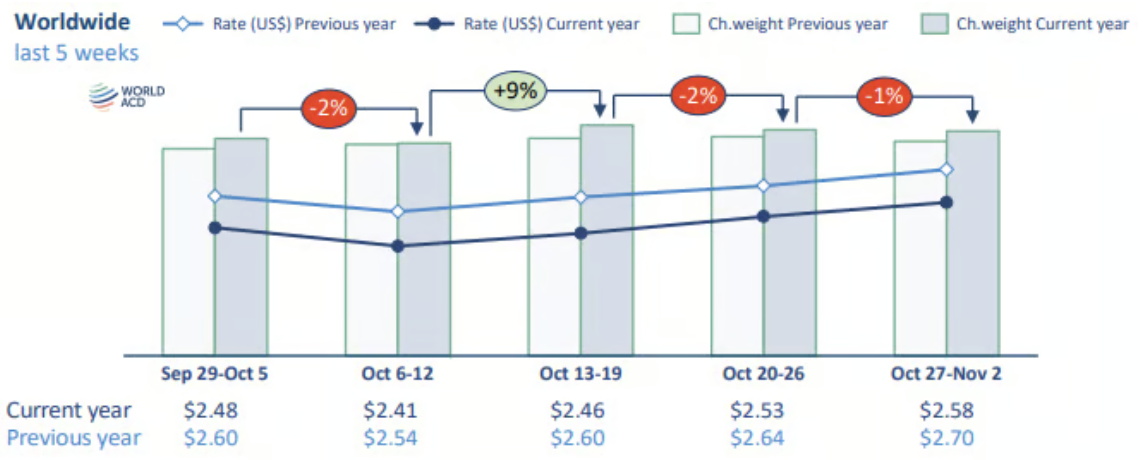

On the pricing side, average worldwide rates for the first 10 months of this year were more or less equivalent to their level last year, even though the totals for each month have been in deficit, YoY, since May.

October month-on-month increase of 8%

The air cargo market data provider noted that in what is normally a key peak-season month, volumes in October rebounded with a 8% increase compared with September, thanks to strong month-on-month (MoM) increases from North America (11%, MoM), Central & South America (11%), Europe (+10%), Asia Pacific (8%), and Africa (7%), with tonnages from Middle East & South Asia (MESA) flat.

Average worldwide air cargo rates stood at US$2.48 per kilo in October, inching up 1% month‑on‑month on the back of a 3% rise from Asia Pacific origins. But WorldACD noted global averages fell 5% year‑on‑year, with Asia Pacific down 6%, leaving rates below last October’s levels. Europe was the only major origin to post a year‑on‑year gain, up 1%.

Worldwide average spot rates fell 4% year‑on‑year in October, mirroring trends in contract rates. Spot rates from Europe origins held steady at US$2.17 per kilo, while sharp declines were recorded from MESA (‑27%), Asia Pacific (‑7%), and North America (‑3%).

(Photos: WorldACD)

Similar patterns to October 2024

Compared with last October, October 2025 is showing some very similar patterns, with both months recording a 8% MoM increase in worldwide tonnages and a 1% rise in average global rates. And the MoM tonnage changes for the six main origin regions are similar in October 2025 to those in October 2024, although this year tonnages from Asia Pacific origins rebounded more strongly (8%, MoM) than last year (5%, MoM).

The main difference is that average global rates this October are around -5% lower, YoY, despite tonnages being 4% higher.

WorldACD said factors within those comparisons include lower jet fuel prices this year compared with last year, and a weaker US dollar, although those two factors more or less cancel each other out in terms of their impact on worldwide air cargo rates.

"A more-significant factor this year has been the extremely volatile transpacific air cargo market, where the effects of changes in US import tariffs and 'de minimis' rules are still playing out," the analysis said.

"But in general, the diversion of Chinese e-commerce volumes from US markets to other international markets, along with the freighter capacity to transport them, has been a factor in driving down average worldwide rates since April and May, when the higher US import tariffs and de minimis changes started taking effect, despite the YoY increase in tonnages overall."

China-US spot rates rebound as YoY tonnage deficit narrows

Looking at this year's most-volatile market, Asia Pacific to the US, spot rates to the US from China, Hong Kong and Japan rose for the third consecutive week in week 44, although all three remain below their levels this time last year – as they have for the last three months.

China to the US spot prices edged up by a further 2% in week 44 (October 26 to November 4), WoW, to US$5.59 per kilo, their highest level this year, while Hong Kong to the US and Japan to the US spot prices rose by 5% and 11% respectively, to US$5.49 and US$6.15 per kilo.

WorldACD reported spot rates were 5%, 12%, and 7% below year‑ago levels, when prices had already begun climbing ahead of the winter holidays.

Meanwhile, tonnages from Asia Pacific to the U.S. remained higher year‑on‑year in week 44 (+7%), continuing the strong gains seen throughout 2025. Taiwan (+44%), Vietnam (+32%), Thailand (+37%), Malaysia (+52%), and Singapore (+51%) all posted sharp increases. By contrast, flows from China, Hong Kong, Japan, and South Korea, which have mostly shown double‑digit declines this year, recorded smaller deficits in week 44 at ‑4%, ‑9%, ‑2%, and ‑5%, respectively.