Major ocean carriers saw their earnings plunge by approximetaly 70% in the third quarter of 2025 compared to the same period last year, though results remained well-above 2019 pre-pandemic levels.

Sea-Intelligence said in a new analysis that major ocean carriers reported combined Earnings before interest and taxes (EBIT) of US$5.12 billion – a sharp decline from the US$17.06 billion recorded in the third quarter of the year, which was then a 600% increase over the same period in 2023.

"That said, despite the double-digit freight rate drops, the market floor has not fallen through," the Danish maritime consultancy and data analysis firm specializing in container shipping and global supply chains, said.

"Profitability remains well above the pre-pandemic levels of 2019, indicating that the market has settled into a sustainable 'new normal,'" it added.

Sea-Intelligence noted that while financial results softened, operational data points to resilience.

"Global transported volumes grew for 6 of the 7 reporting carriers, suggesting that the influx of new vessel deliveries and reworked service networks have allowed shipping lines to absorb the longer Red Sea transit times without the panic-pricing seen last year," teh analysis said.

(Source: Sea-Intelligence)

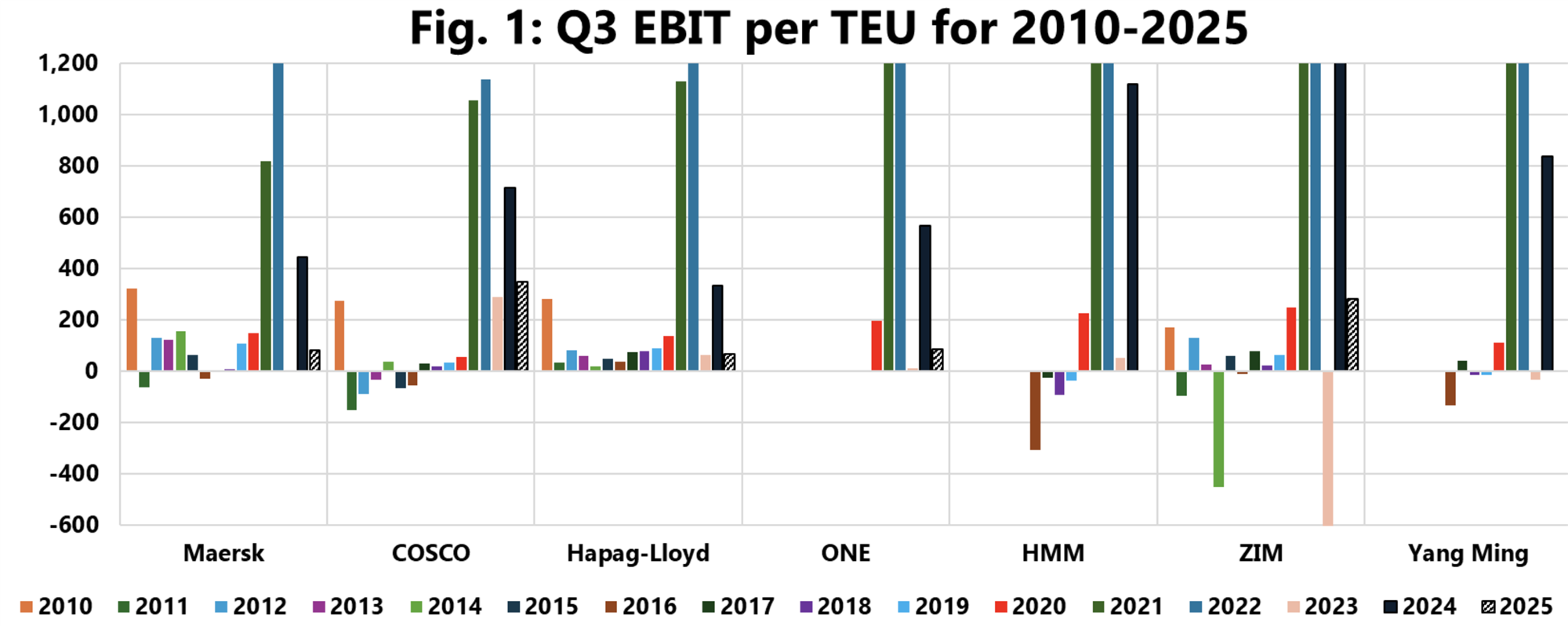

Figure 1 illustrates the development in unit profitability (EBIT per TEU). COSCO recorded the highest EBIT/TEU in Q3 2025 at US$350/TEU followed by ZIM at US$280/TEU.

Sea-Intelligence noted that these were the only two carriers to maintain unit profitability above US$200/TEU.

"The remaining major carriers – ONE (US$85/TEU), Maersk (US$83/TEU), and Hapag-Lloyd (US$65/TEU) – saw their margins compress significantly, dropping below the US$100/TEU mark," said Alan Murphy, CEO, Sea-Intelligence.

"This stands in sharp contrast to the same period last year, where the lowest EBIT/TEU in this group was US$335/TEU, highlighting the extent of the post-peak market correction," he added.