Global air cargo demand rose 3% in the final week of January, holding firm despite weather‑related disruptions and showing no sign of the usual pre‑Lunar New Year surge, according to WorldACD Market Data.

Worldwide chargeable weight in week 5 (Jan. 26–Feb. 1) posted a fourth straight week‑on‑week increase, supported by strong flower shipments from Central and South America and East Africa ahead of Valentine's Day.

Tonnages from Central and South America jumped 21% week over week, while Africa rose 11%.

But with Lunar New Year falling more than two weeks later this year than in 2025, WorldACD said there was no evidence of a significant seasonal spike in volumes from Asia Pacific.

(Photo: WorldACD)

Traffic from the region was flat overall, with gains from Vietnam (+9%), Taiwan (+12%) and a modest uptick from China (+1%) to the U.S. offset by declines from most other origins. Severe winter weather in the U.S. also contributed to flight cancellations and softer flows.

Spot rates from Asia Pacific to the U.S. rose 5% week over week, supported by increases across most major origins.

Traffic to Europe showed a similar pattern: overall tonnages dipped 1% week over week, but Taiwan (+12%), South Korea (+7%), Malaysia (+5%) and Thailand (+2%) all posted gains. Spot rates to Europe climbed 3% week over week, including a 6% rise from China.

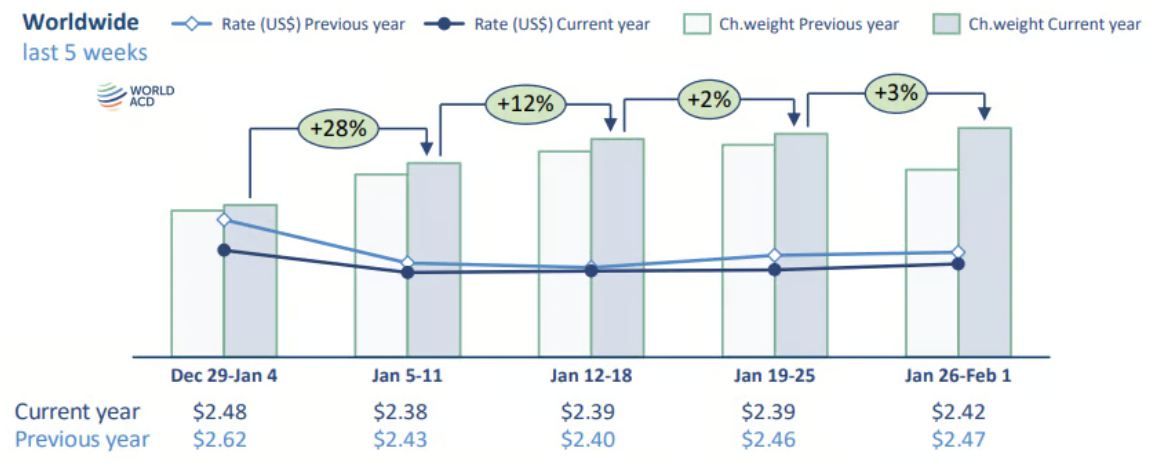

Globally, average full‑market rates reached US$2.42 per kilo in week 5, up 1% from the previous week and 2% below the same week last year. Average global spot rates rose 2% to US$2.68 per kilo, roughly matching year‑ago levels.

WorldACD cautioned that year‑on‑year comparisons are heavily skewed by the earlier Lunar New Year in 2025, when Asia Pacific volumes had already dropped sharply by week 5.

As a result, chargeable weight from the region was up 50% year over year in week 5, with global tonnages up 22%.

Preliminary January data shows global volumes up 9% year over year but 6% below December levels. Average worldwide spot rates for the month fell 8% from December to US$2.65 per kilo, down 1% year over year.

Asia Pacific 2025 full‑year trends

WorldACD's latest analysis highlights shifting trade patterns over the past year. Combined 2025 tonnages from mainland China and Hong Kong to the U.S. fell 7%, while volumes to Europe rose 9%.

Hong Kong's exports to the U.S. dropped 13% year over year, compared with a 4% decline from mainland China. To Europe, Hong Kong volumes rose 13% and China’s increased 7%.

Those trends continued into January: combined China/Hong Kong tonnages to the U.S. were down 10% year over year, while flows to Europe rose 18%, driven by a 26% jump from Hong Kong and a 14% rise from China. Lunar New Year timing again influenced the comparisons.

Southeast Asia showed even sharper contrasts. Full‑year 2025 tonnages from the region to the U.S. surged 29%, while volumes to Europe slipped 4%.