WorldACD reported that air cargo demand in May continues to track pre-pandemic levels although regional performance still show mixed results.

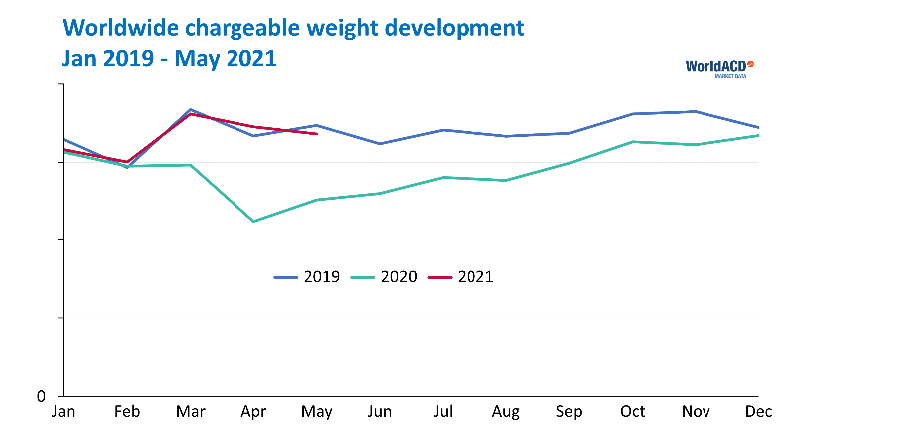

The air cargo data provider said air cargo demand in chargeable weight "shows that the worldwide volumes so far in 2021 behave very much like in 2019." In May, it was only 1% below the level seen during the same period in 2019 —used for comparison given the Covid-19's impact in 2020.

Overall volume for the first five months of 2021 is 20% above 2020, WorldACD noted, but is roughly in line with two years ago before the coronavirus dragged the whole industry.

Mixed regional performance

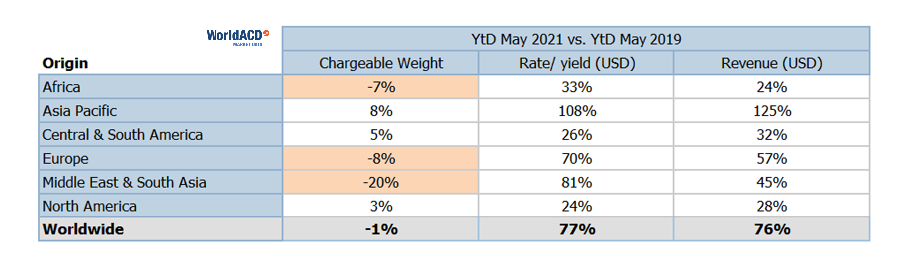

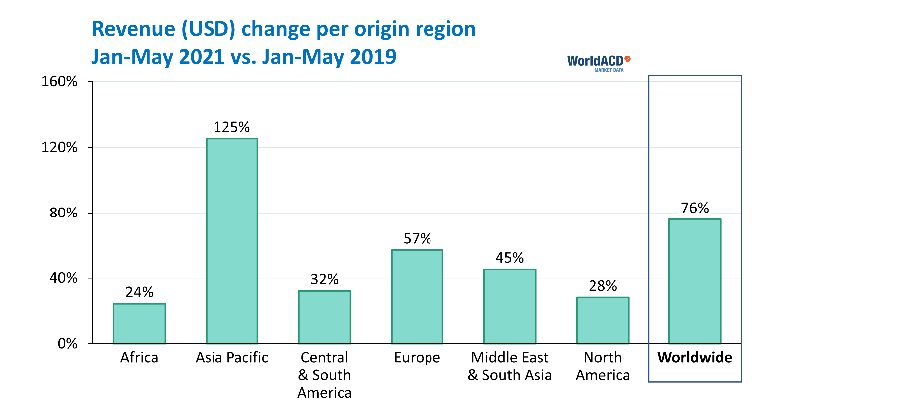

But the results are mixed per region. May volumes were up from 2019 levels in Asia Pacific (8%), central and south America (5%) and North America (3%), while declines were recorded in Europe (-8%), Middle East and South Asia (-20%) and Africa (-7%).

"When we look at this on a more detailed geographic level, the picture is very different ... [while] the origin regions Africa, Europe and Middle East & South Asia are below 2019 volume levels, Asia Pacific, Central & South America and North America are above 2019 levels," WorldACD said.

"In other words, different markets show different performances: it matters where you do business," it added.

Rates meanwhile continued to surge compared to two years ago across all the regions — although at varying levels — due to capacity constraints that continue to plague the industry.

"Divergent picture" on rates

WorldACD said when it comes to rates although all regions showed increases, Asia Pacific led the surge. North America recorded a 24% rise, while rates in Asia Pacific increased by 108%.

"The latter market may receive a lot of attention, but that does not mean it is representative for the industry ... though all regions have double digit increases compared with 2019, Asia Pacific clearly is in a league of its own," WorldACD said.

The air cargo data provider also looked at the provisional June figures for the last five weeks, and found that results in both volumes and rates are in line with seasonal trends. It said the worldwide average rate has consistently dropped over the last 5 weeks.

"We consulted our database to track volume changes from May to June for the past ten years. On average, we saw a decline of 0.4%. In other words, nothing unusual to be found in June 2021 volumes: the month will end up following the 2019 trend we noted for the first five months of the year," WorldACD said.

"Volume-wise, June looks slightly lower than May: seasonal pattern or some other influence? We consulted our database to track volume changes from May to June for the past ten years," it added. "On average, we saw a decline of 0.4%. In other words, nothing unusual to be found in June 2021 volumes: the month will end up following the 2019 trend we noted for the first five months of the year."