The global economic outlook has darkened, according to the latest analysis from the International Monetary Fund (IMF), and growth across Asia and the Pacific is poised to slow further amid the continuing impact of Russia's invasion of Ukraine and other shocks.

The IMF said economic growth in Asia and the Pacific is projected to decelerate to 4.2% this year, 0.7 percentage points less than its forecast in April and slower than the 6.5% growth in 2021.

It also lowered its 2023 forecast to 4.6%, down by 0.5 percentage points.

"Risks that we highlighted in our April forecast—including tightening financial conditions associated with rising central bank interest rates in the United States and commodity prices surging because of the war in Ukraine—are materializing. That, in turn, is compounding the regional growth spillovers from China's slowdown," IMF said.

China slowdown deepens

Photo: IMF

Photo: IMF

IMF noted that China, Asia's largest economy, saw a significant deceleration in the second quarter as the zero-COVID policy prompted lockdowns for major cities and supply-chain hubs.

Accordingly, its full-year growth forecast for the country has been lowered to 3.3% from 4.4% in April, and IMF said it now expects 4.5% growth next year, a reduction of 0.6 percentage points.

Such a decline in activity, which also reflects a prolonged and intensifying slump in the real estate sector, is likely to have sizeable spillovers on regional trading partners, IMF said, adding that Japan and Korea, the two largest regional economies integrated closely with global supply chains and China, will also see growth slow on weaker external demand and disruptions to supply chains.

But despite China's recent slowdown, IMF noted that there's been "signs of a rebound" in economic activity emerging as some pandemic restrictions on mobility are now being gradually eased.

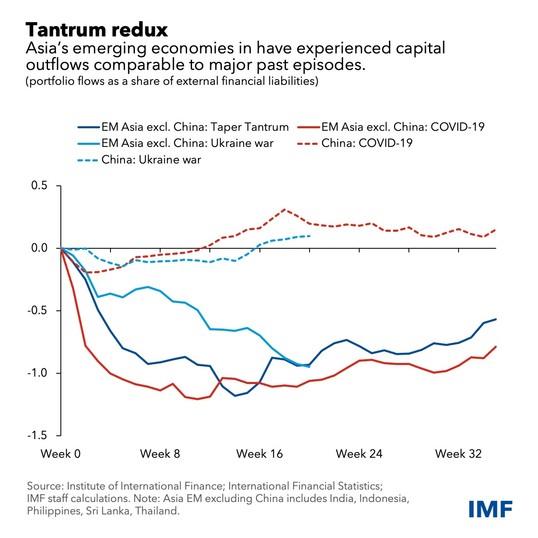

IMF also pointed out that most emerging market economies in Asia, excluding China, have experienced capital outflows comparable to those in 2013, when the Federal Reserve hinted it might taper bond buying sooner than previously expected, causing global bond yields to rise sharply.

"The outflows have been especially large for India: US$23 billion since Russia's invasion of Ukraine. Outflows have also occurred from some advanced Asian economies such as Korea and Taiwan Province of China, as the Fed signals continued rate hikes and geopolitical tensions reverberate," it added.

Ramifications of war

IMF said furthermore, increased trade policy uncertainty and a fraying of supply chains, which contribute to the trend toward geoeconomic fragmentation, is expected to delay the economic recovery and exacerbate scarring from the pandemic in Asia—one of the biggest beneficiaries of decades of deepening global trade and financial integration.

"While growth is weakening, Asian inflation pressures are rising, driven by a global surge in food and fuel costs resulting from the war and related sanctions," the report said.

"That hits the poor and vulnerable the hardest, who are least able to cope, hurting consumption and raising the chances of social unrest, as seen in Sri Lanka, and in other countries," it added.

Asia's growing inflation pressures remain more moderate compared with other regions, but price increases in many countries have been moving above central bank targets, IMF further said.