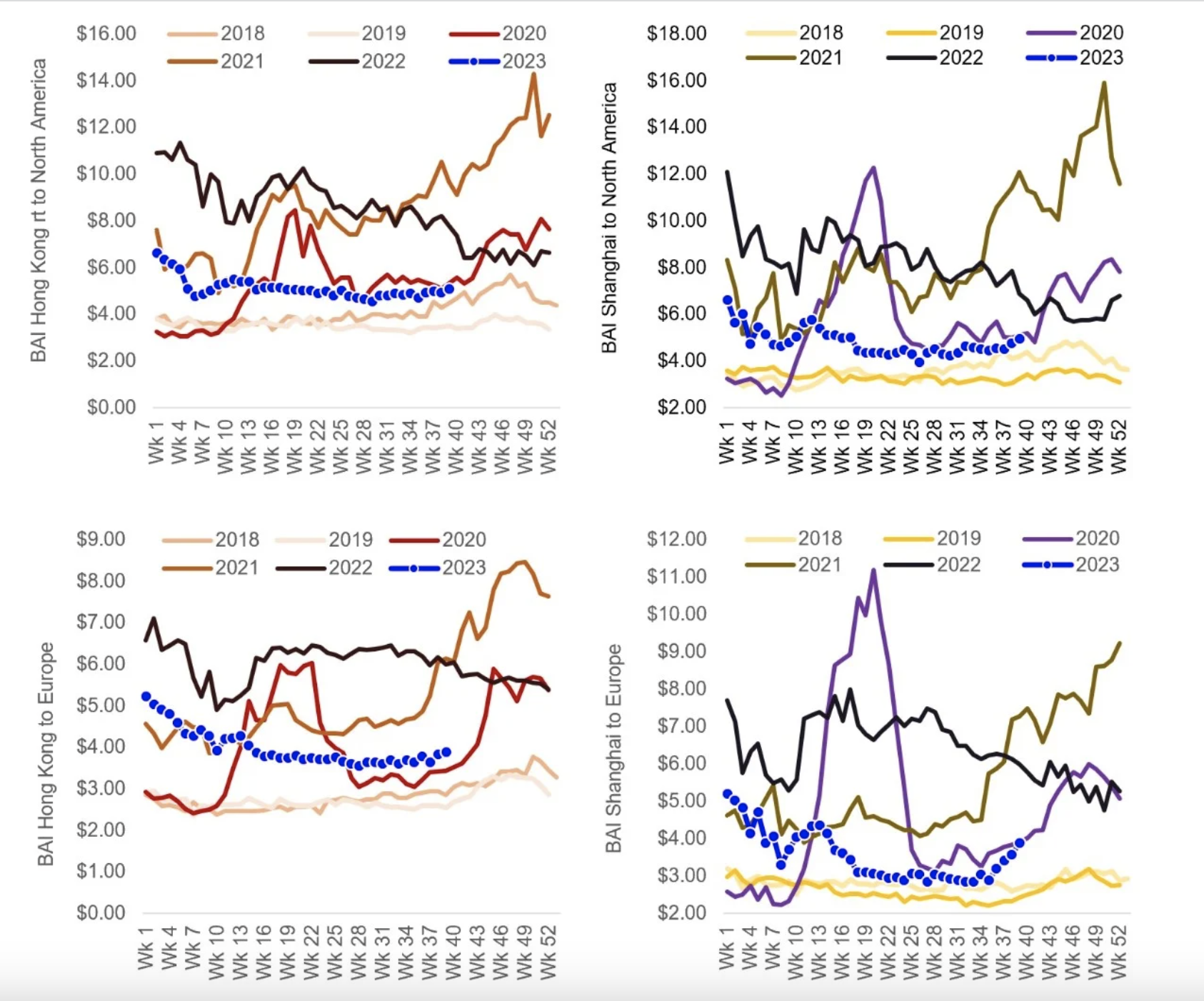

Airfreight rates ticked up healthily through September on major Asia-outbound lanes, giving credence to the possibility of a peak season in 2023.

Writing in a Baltic Air Freight Index (BAI) newsletter, Bruce Chan, director and senior research analyst covering global logistics and future mobility at Stifel, noted that while Transatlantic rates were flat, with Frankfurt to North American (BAI22) pricing down 1.7% since August, Hong Kong to North America (BAI 32) and Shanghai to North America (BAI 82) increased 8% and 11%, respectively, in September versus the previous month.

Meanwhile, it added that in Hong Kong to Europe (BAI 31) and Shanghai to Europe (BAI 81), monthly rates rose 7% and a healthy 34%, respectively.

Rates still well below 2022 level

"These increases follow what have been consistently low rates all year as demand fundamentals have been, in our view, soft," Chan said.

"While recent increases are a positive indication that could suggest a stabilising market, we think it may be premature to celebrate," he added.

"Rates are still well below where they were last year and where they started this year, and supply continues to enter the market."

Exhibits 1-4: Rates on Asia outbound lanes ticked up in September vs. August after being flat for most of the year [Source: Baltic Air Freight Index, Stifel Format]

Citing IATA data, Chan noted that capacity — as measured by available cargo tonne-kilometres — or ACTKs) was up more than 11% year on year in July, the last available reading.

"... We believe that passenger belly capacity continues to re-enter the market, which will continue to put pressure on pricing," he said.

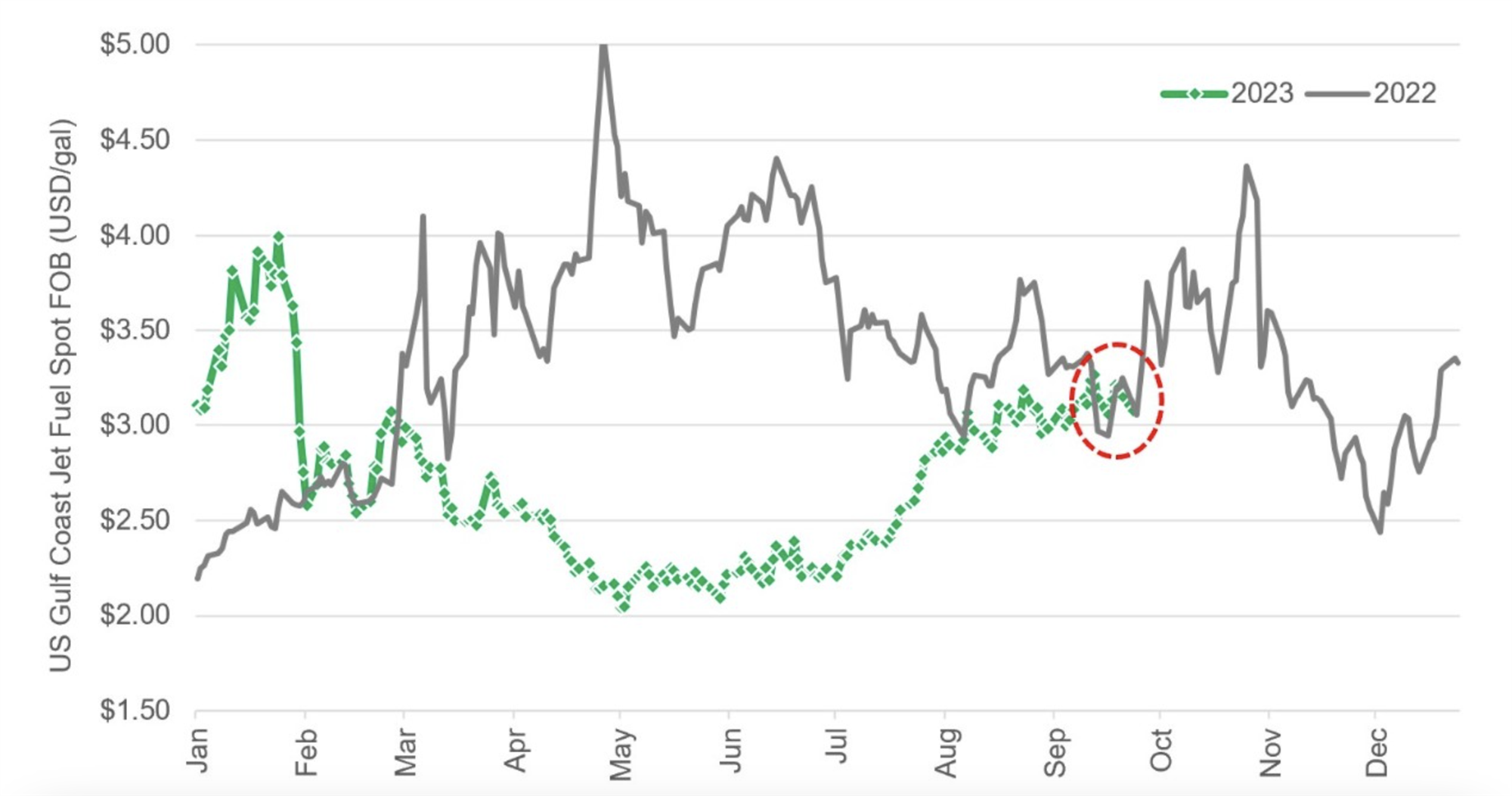

Moreover, Chan noted that average fuel prices are up in the mid-single-digit percentage range in September compared to August, accounting for roughly half of the overall rate increases on certain lanes.

Exhibit 5: US Gulf Coast jet fuel spot prices have climbed steadily since summer, accounting for a sizeable chunk of recent rate increases. [Source: US Energy Information Administration; Stifel format]

The analysis also noted that on its most recent investor call, FedEx stated that it does not see much likelihood of a peak season this year and, on that basis, guided investors to flat revenue over the next year.

He pointed out that UPS also reiterated comments from its previous earnings call and likewise pointed toward a flat peak.

Potential better-than-expected finish to 2023

"So, could we be seeing emerging evidence of a better-than-expected finish to 2023? Potentially, but with inflationary pressure and rising energy prices putting a strain on consumer discretionary spending, the likelihood of a breakaway restocking is unlikely in our view," he added.

Chan further said that while they think inventories have, for the most part, bottomed, "we also think the risk of fundamental demand grinding lower, coupled with the memory of last year's overstocking, will likely lead shippers to position conservatively."

"As capacity and inventories both come back into balance, core demand should once again become the primary determinant of air cargo rates, but that does not make it any easier to forecast," he said.

"For now, we continue to expect a modest sequential rise in pricing through the end of the year, although pricing will generally remain well below last year," Chan added.