Aviation article(s)

Rating

ASIA-PACIFIC OFFICE RENTS REMAIN STABLE IN Q3 2023

October 19, 2023

The overall logistics rent in the Asia Pacific region moderated in the third quarter, according to Knight Frank, driven decline in the Chinese markets.

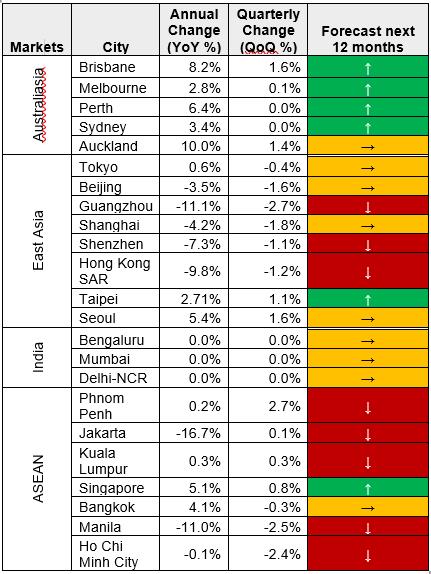

Knight Frank, the independent global property consultancy, has released its latest Asia-Pacific Prime Office Rental Index for Q3 2023, which showed a moderation in rental decline, falling 1.3% from a year ago, down from the 1.5% drop observed in the previous quarter.

"On a quarter-on-quarter basis, the average rents across the region showed stability, with declines in the Chinese Mainland markets moderating," Knight Frank said. "This was further counter-balanced by rental growth in most other developed markets."

Overall, the quarterly report indicated that in line with Q2 2023, 15 of the 23 tracked cities reported either stable or increasing rents.

Meanwhile, Knight Frank said vacancies continue to rise by 0.4 percentage points on a quarter-to-quarter basis to 14.4%.

This ongoing trend has resulted in the metric consistently surpassing 10-year highs since Q3 2022.

For Q3 2023, the report saw a 0.0% quarter-on-quarter (QoQ) change for the Asia-Pacific Rental Index in Q3 2023.

Auckland recorded the highest year-on-year growth during that quarter — and 15 of 23 tracked cities recorded "stable or increasing rents" compared to the same period in 2022.

The report said offices in Southeast Asia's emerging markets continued to be weighed on by double-digit vacancies.

It added that in Singapore, the market remained robust on corporate relocations and a flight-to-quality trend and rental growth is flattening out

"Despite vacancies rising in the region, rental declines in the third quarter have stabilised, supported by a trend favouring flight-to-quality properties. Overall, the current expansionary cycle in the region affords occupiers a broader range of options and strategies to consider, enhancing their ability to secure favourable lease terms amid current soft conditions," said Tim Armstrong, global head of occupier strategy and solutions.

"While it is still premature to make a definitive judgement amidst the most recent political developments, the evolving geopolitical landscape is expected to cast a shadow on occupier prospects as companies meticulously evaluate the accompanying risks," he added, noting that as businesses adapt to a future hybrid work model, the trio of location, amenities, and sustainability have gained significance in rebalancing the scales in favour of in-person work.

[Source: Knight-Frank]

Christine Li, head of research Asia-Pacific, said vacancies rose despite a notably subdued completion pipeline of just over a million square meters in the quarter, marking a steep decline of approximately 75% from Q2 2023, as absorption trails behind the rate of new constructions in the region.

She added that monetary tightening, inflationary pressures and geopolitical events continue to weigh on economic sentiment, as occupiers remained cautious, taking longer to consider space requirements.

"The backdrop of monetary tightening, inflationary pressures, and ongoing geopolitical events cast a shadow on economic sentiment, resulting in occupiers exercising caution and taking extended time to evaluate their space requirements," Li said.

With the implementation of hybrid work schedules, occupier strategies have decoupled from mere headcount considerations.

Knight Frank said more than half of the occupiers surveyed believe that their organisations will embrace hybrid workstyles in the next three years.

"This will continue to place emphasis on space optimisation strategies. Evolving strategies will likely dampen leasing velocity for the rest of the year, even as macroeconomic volatility hampers occupier ambitions," Li said.

"Consequently, market conditions across most of the region will continue to favour tenants into the initial stages of 2024," she added.