Congestion at major Northern European ports is expected to persist through 2025, while Transpacific trade faces falling freight rates amid worsening overcapacity, according to new analysis from Xeneta.

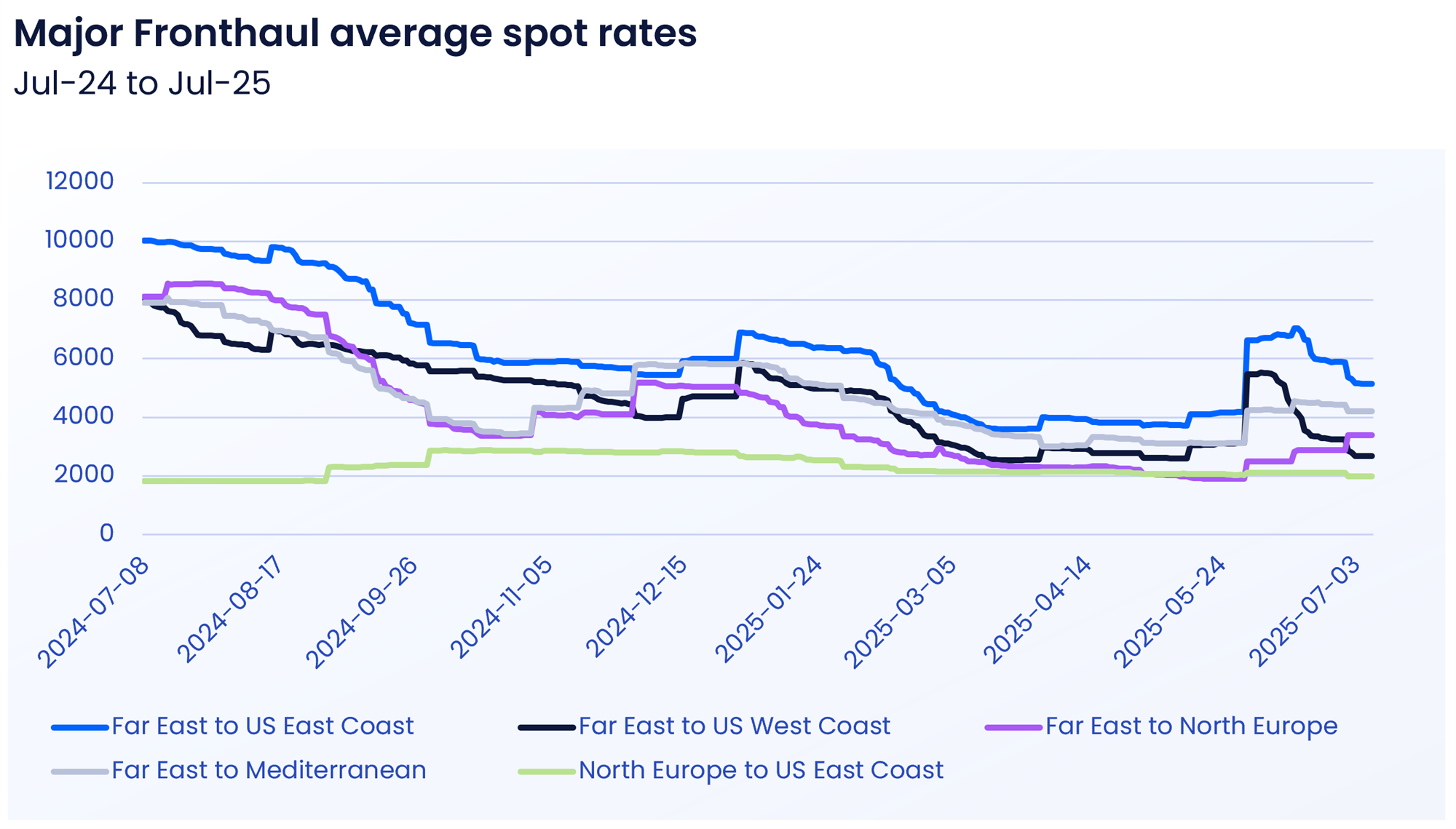

Market average on the Transpacific trade from the Far East to the US West Coast accelerated its decline in the early days of July, down 18% from end-June and falling below the level seen in the second half of May.

Xeneta noted that with carriers now deploying more capacity above the level required to meet shippers' demand, "spot freight rates are likely to soon be at the lowest level since end-2023."

Market average spot rate for Far East to US East Coast, on the other hand, rose in the first half of June, but has since fallen 27% to US$5,151 per FEU on July 8 — and the analysis pointed out that this trade has seen a "delayed" capacity response from carriers following temporary lowering of US tariffs, causing rates to hold up in June.

[Source: Xeneta]

The ocean freight rate benchmarking and market intelligence platform said in the new report that more "severe" overcapacity was seen on the US East Coast in the early days of July. The average spot rate from the Far East into the US East Coast is down 5% in early July from end-June.

"Geo-politics has upset the natural order of ocean container shipping on Transpacific trades in Q2, and shippers are still struggling to make sense of the situation," said Peter Sand, chief analyst at Xeneta.

"Shippers need to act decisively to protect supply chains, but this becomes more difficult when they see abnormal trends such as Far East fronthaul freight rates collapsing into the US West Coast while holding stronger into the US East Coast."

Sand noted that average spot rates into the US West Coast have fallen 51% in just over a month. "Carriers will be desperate to arrest this decline, so the flooding of capacity we have seen on this trade since the temporary lowering of tariffs will stop. That means average spot rates into the US East Coast will decline at a faster rate and likely fall to within US$1,000 of rates into the US West Coast by the end of July – a much more familiar scenario for shippers."

North Europe port congestion here to stay

Meanwhile, the Xeneta chief analyst said congestion at some of the major ports in North Europe could persist through the rest of the year.

"Severe congestion is spreading across North Europe ports – and the bad news is it's here to stay for the remainder of 2025, causing operational disruption and pushing freight rates up," Sand said.

"Average spot rates from Far East to North Europe were up 18% on July 4 compared to end-June, while carriers have been forced to revise service schedules, whether that is avoiding port calls in congestion hot spots or calling at ports they would not ordinarily do so."

"This causes disruption that becomes exponentially difficult to unwind and another painful headache for shippers," he added.