Air traders in Hong Kong are entering the first quarter of 2026 with cautious optimism, as DHL's latest Air Trade Index shows overall sentiment holding steady despite soft global economic conditions and rising logistics costs.

According to the latest DHL Hong Kong Air Trade Leading Index (DTI) report — commissioned by DHL Express Hong Kong and compiled by the Hong Kong Productivity Council (HKPC) — the air trade landscape in Q1 2026 remained stable, signaling trade resilience and alignment with the indices' recent performance.

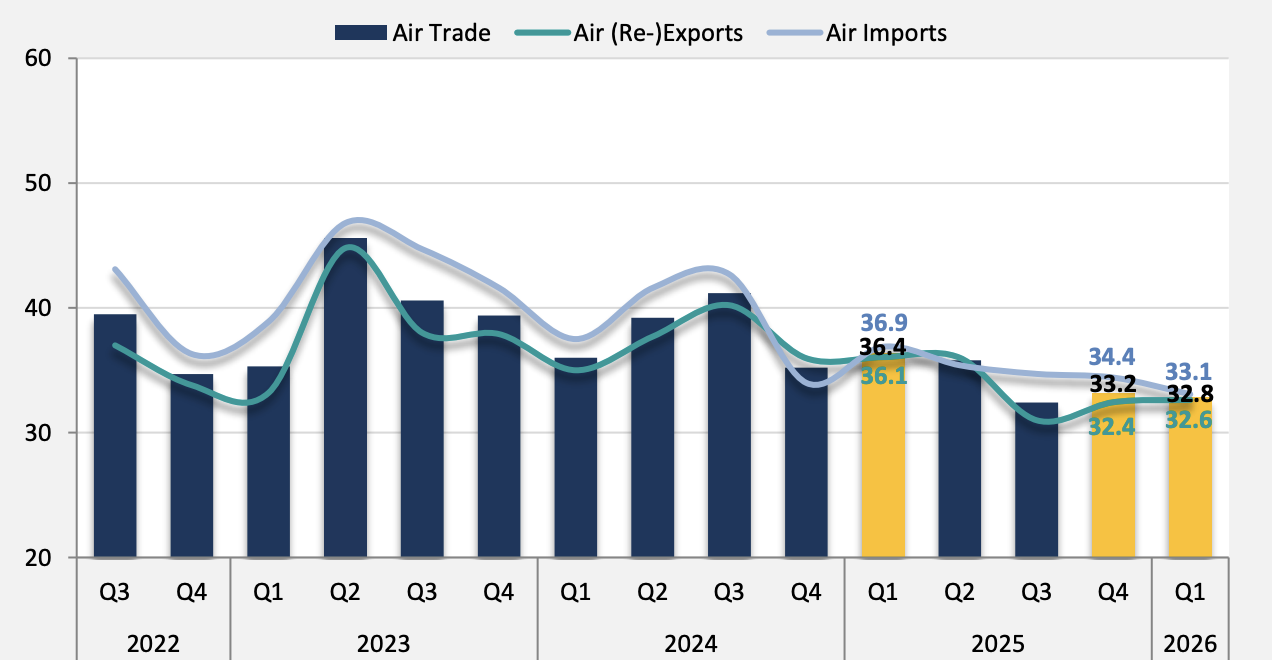

"The Overall Air Trade Index held steady at 32.8 in the first quarter of 2026, reflecting resilience and alignment with recent performance (33.2 in Q4 2025 and 32.4 in Q3 2025). This stability underscores air traders' continued confidence, even amid prevailing external uncertainties.

The report noted that across regions, the Europe index reflects positive growth momentum, while Asia Pacific faces certain challenges.

"Sentiment remains cautiously optimistic. Two-thirds of air traders expect shipment volumes to remain stable or increase, reflecting sustained business activity," it said, noting that this is buoyed by resilient re‑export activity and strong prospects in the Chinese Mainland and emerging Southeast Asian markets, even as China–US trade tensions and subdued consumer demand continue to weigh on the outlook.

The report noted that the Chinese Mainland is recognised as the "leading market" with the greatest growth potential. Southeast Asian economies—including Vietnam (18%), Thailand (14%), Malaysia (12%), and Singapore (11%)—were also identified as attractive secondary markets for business expansion.

Meanwhile, weak global economic conditions and low consumer demand remain top concerns for 2026, compounded by rising China–U.S. trade tensions, and persistently high logistics costs that continue to squeeze operational margins.

In response, the majority of air traders (73%) intend to maintain their 2026 pricing at 2025 levels, while 18% plan to implement price increases. Within this group, 50% anticipate adjustments of 3%-6%, 28% expect increases above 6%, and 23% will apply more modest changes of less than 3%.

With Chinese New Year approaching, seasonal demand is also expected to rise, particularly for apparel & clothing accessories as well as gifts, toys, and houseware products.

During the traditional peak season in Q4 2025, air traders' performance largely aligned with expectations, with 55% reporting outcomes consistent with expectations.

However, 42% fell short of projections, while only 3% surpassed expectations, underscoring the complexities of the current operating environment.

"Air trade is expected to remain stable in Q1 2026, with (re-)exports continuing their upward trajectory and Europe reinforcing its position as the leading market," said Edmond Lai, chief digital officer of HKPC.

He noted that while Asia Pacific may face "short-term challenges," the outlook for 2026 remains promising, driven by strong potential in the Chinese Mainland and emerging opportunities across Southeast Asia.

"The strength in product variety and shipment urgency highlights traders' agility to meet diverse and time-sensitive demand. Looking ahead, air traders anticipate a steady pricing environment and are preparing to capture growth in key," Lai added.

The DTI analyzes the key attributes of business demands based on a survey of more than 600 Hong Kong companies that focus on in- or outbound air trading.

An index value above 50 indicates an overall positive outlook, while a reading below 50 represents an overall negative outlook for the surveyed quarter. The further the reading is from 50, the more positive or negative the outlook is.