Maersk raised its full-year profit forecast to as much as US$9.5 billion after reporting stronger-than-expected second-quarter results, citing resilient global demand outside the United States and improved performance across its terminals, ocean, and logistics segments.

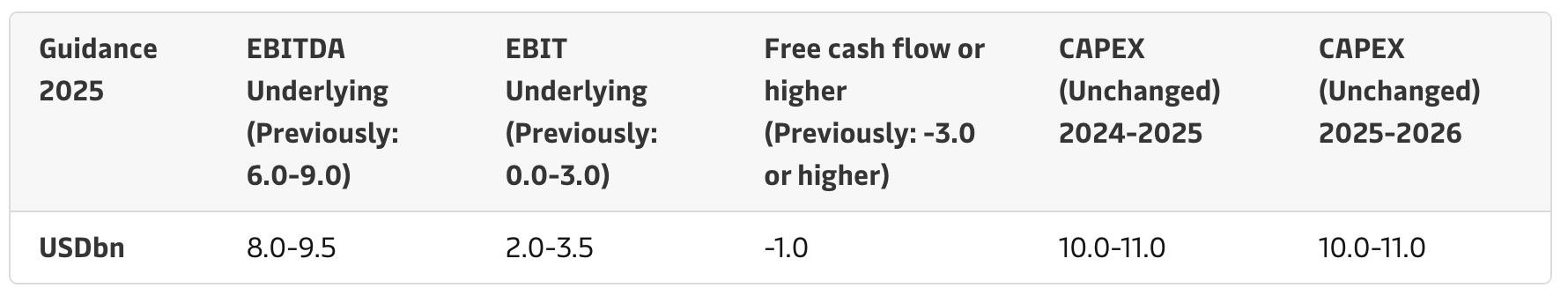

The Danish shipping giant lifted its full-year EBITDA guidance to between US$8 billion and US$9.5 billion, up from a previous range of US$6 billion to US$9 billion. The upgrade follows a 7% year-over-year rise in second-quarter EBITDA to US$2.3 billion, with revenue climbing nearly 3% to US$13.1 billion.

EBIT rose to US$1.6 billion, reflecting improved margins across its logistics and terminals units.

[Source: Maersk]

"We have had a strong first half of the year, driven by consistent follow through on our operational improvement plans and the successful launch of the Gemini Cooperation," Vincent Clerc, CEO of Maersk, said.

"Our new East-West network is raising the bar on reliability and setting new industry standards. It has been a key driver of increased volumes and solid delivery of our Ocean business. Even with market volatility and historical uncertainty in global trade, demand remained resilient, and we’ve continued to respond with speed and flexibility," he added.

Maersk also revised its global container market volume growth forecast to 2–4%, citing robust exports from Asia and continued strength in its terminals and logistics segments.

Maersk reported that its Ocean business delivered good results in a quarter marked by significant volatility in demand and rates. Volumes grew 4.2% compared to the same quarter last year, mainly driven by exports out of Asia, with freight rates picking up in the quarter, while still being under pressure both sequentially and compared to the previous year.

It added that the Gemini Cooperation was successfully phased in fully in June, with reliability scores above the 90% target in its first few months of operation.

Logistics & Services continued to focus on operational efficiency and delivering sustainable profitability improvement. EBIT increased by 39% to US$175 million, and EBIT margin was 4.8%, up from 3.5% in the same quarter last year.

Maersk said it was also another strong quarter in its Terminals business with record-high volumes and revenue. Volumes increased 9.9% and were supported by the successful phase-in of the Gemini cooperation, adding more Maersk Ocean volumes to the Terminals business. EBIT increased by 31% to US$461 million, driven primarily by strong operational and joint venture performance.

Red Sea disruption seen to persist through the year

"Given the more resilient market demand outside of North America, Maersk raises its full-year 2025 financial guidance ... The expected global container market volume growth has been revised to between 2% and 4% (previously between -1% and 4%)," Maersk added, although noting that at this time, disruption in the Red Sea is still expected to last for the full year.

The Danish shipping line noted that its guidance for 2025 is, however, subject to considerable macroeconomic and geopolitical uncertainties impacting container volume growth and freight rates.