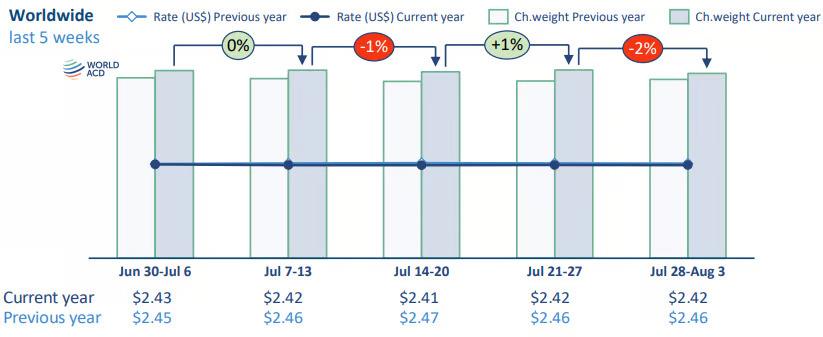

Global air cargo volumes declined 2% in week 31 (July 28–Aug. 3) compared to the previous week, continuing a pattern of marginal weekly shifts that kept overall chargeable weight stable throughout July, according to a new report from WorldACD.

Despite the late-week dip, tonnage rose 8% month-on-month in July, lifting volumes to a 6% year-on-year increase—up from just 1% YoY growth in June and more in line with gains seen between March and May.

Global air cargo pricing held steady in July, with year-on-year volume growth only slightly outpacing capacity gains (+5%).

WorldACD reported year-over-year volume growth across all regions, led by Asia Pacific with a 9% increase. North America and Central & South America each rose 5%, followed by the Middle East & South Asia at 4% and Europe at 3%. Africa remained unchanged.

The momentum slowed towards the end of the month.

WorldACD’s data, based on over 500,000 weekly transactions, showed a 2% year-on-year drop in global rates for July—matching trends from May and June.

Volumes were stable on a two-week-over-two-week basis, though all origin regions saw slight declines of 1–3%, except Europe, which rose 3%. Rate trends varied sharply by region: MESA fell 11% from last year’s elevated levels, Asia Pacific dropped 4%, and North America held flat. Europe and Africa bucked the trend, with increases of 5% and 6%, respectively.

Opposing pricing trends out of North America, Europe

The air cargo market data provider reported that, despite a 6% drop in chargeable weight from North America to Asia Pacific on a two-week-over-two-week basis, rates on that lane rose 2%. Traffic from North America increased 1% to both Europe and Central & South America, with rates up 1% and 3%, respectively.

Meanwhile, carriers out of Europe saw modest rate declines across all major lanes except Central & South America. Rates fell 2% to the Middle East & South Asia and 1% to North America, Asia Pacific and Africa, despite volume growth of 6% to North America, 4% to MESA and 1% to Asia Pacific.

"Despite signals that front-loading had largely run its course and widespread hesitation among shippers owing to uncertainty, July produced an increase in global airfreight movement," WorldACD said.

It added that with tariffs largely falling into place in August, shippers will have better visibility to allow forward planning. "Whether or not this can inject new momentum into global flows or if tariffs will slow down traffic remains to be seen."