Global air cargo volumes inched upward in June, despite ongoing trade disruptions, with performance across key trade lanes reflecting the varied impact of U.S. tariffs.

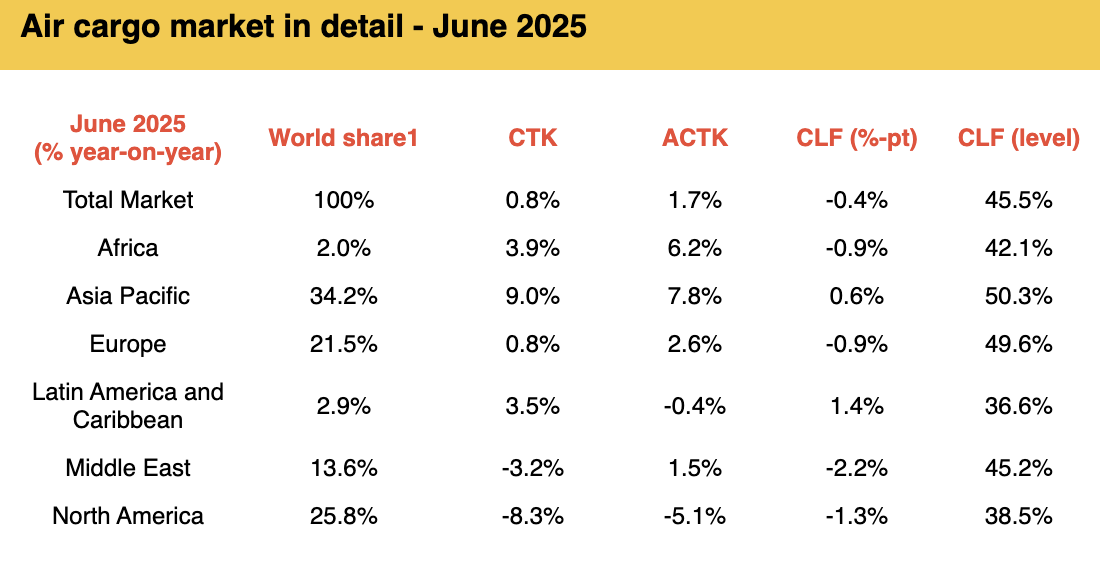

The International Air Transport Association (IATA) released data for June 2025 global air cargo markets showing total demand, measured in cargo tonne-kilometers (CTK), rising 0.8% compared to the same month in 2024. It was up 1.6% for international operations.

In May, IATA said total global air cargo demand rose by 2.2% compared to May 2024 levels.

Capacity, measured in available cargo tonne-kilometers (ACTK), increased by 1.7% compared to June 2024, on the back of a 2.8% rise in international operations.

"Overall, air cargo demand grew by a modest 0.8% year-on-year in June, but there are very differing stories behind that number for the industry's major players," said Willie Walsh, director general of IATA.

He noted that trade tensions saw North American traffic fall by 8.3% and European growth stagnate at 0.8%. But Asia-Pacific bucked the trend to report a 9.0% expansion. Meanwhile, Walsh said disruptions from military conflict in the Middle East saw the region's cargo traffic fall by 3.2%.

"The June air cargo data made it very clear that stability and predictability are essential supports for trade. Emerging clarity on US tariffs allows businesses greater confidence in planning. But we cannot overlook the fact that the deals being struck are resulting in significantly higher tariffs on goods imported into the US than we had just a few months ago," Walsh said.

"The economic damage of these cost barriers to trade remains to be seen," he added, further saying that in the meantime, governments should redouble efforts to make trade facilitation simpler, faster, cheaper, and more secure with digitalization.

Asia Pacific carriers lead growth

Global cargo demand remained steady across most airlines in June, according to IATA, though carriers in North America and the Middle East lagged behind amid trade uncertainties and geopolitical headwinds.

[Source: IATA]

[Source: IATA]

Asia-Pacific airlines saw 9.0% year-on-year demand growth for air cargo in June, the strongest growth of all regions, and capacity increased by 7.8% compared to the same month last year.

European carriers saw 0.8% demand growth as capacity rose 2.6% year-on-year in June.

Latin American carriers saw air cargo demand rise 3.5% year-on-year in June, though capacity decreased by 0.4% year-on-year. African airlines recorded a 3.9% increase in demand for air cargo in June. Capacity increased by 6.2% year-on-year.

Meanwhile, North American carriers saw an 8.3% year-on-year decrease in growth for air cargo in June, the slowest growth of all regions, and capacity decreased by 5.1% year-on-year. Middle Eastern carriers also recorded a 3.2% decline in demand for air cargo in June compared to the same period in 2024. Capacity increased by 1.5% year-on-year.

[Source: IATA]

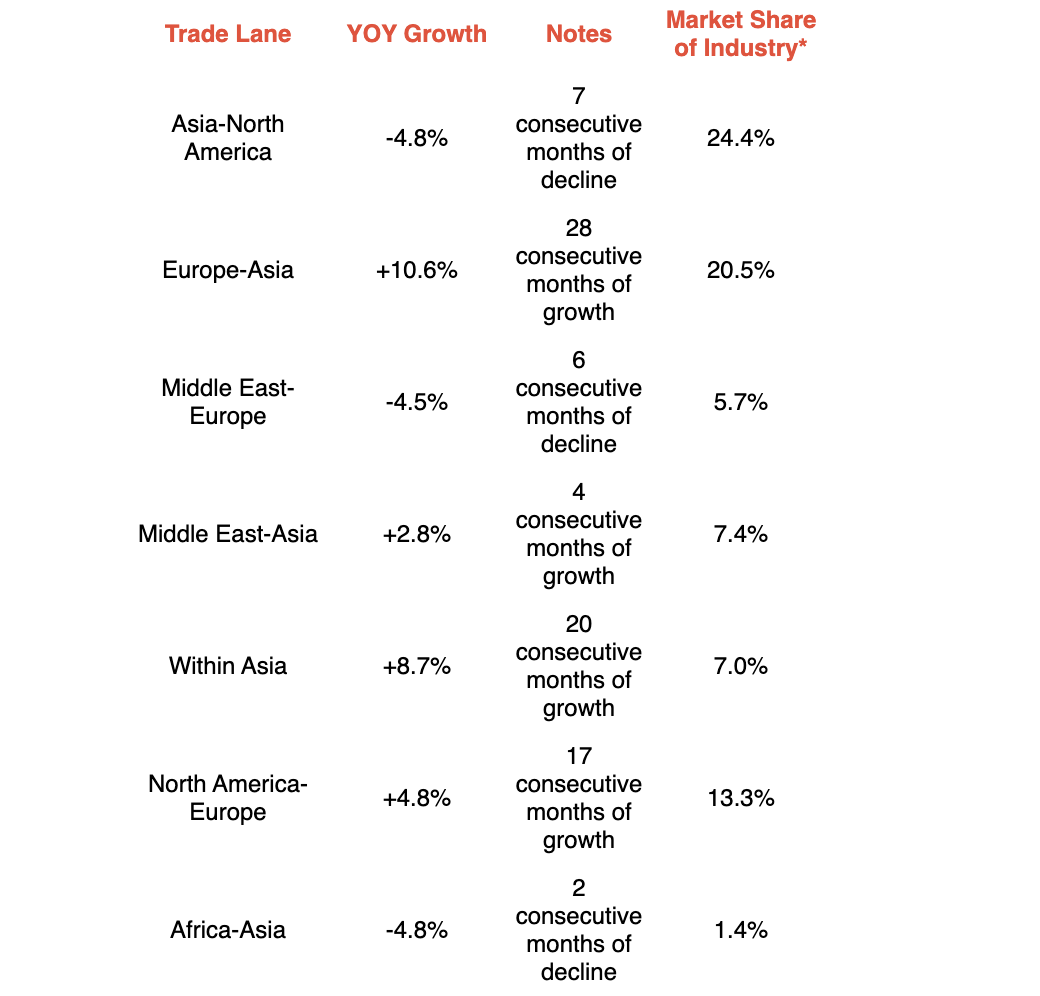

IATA said in terms of trade lane growth, air freight volumes in June 2025 increased for major trade corridors from/within Europe and the Middle East-Asia. However, other relevant trade routes from/within Asia and from North America have decreased significantly in the most recent month.