Global air cargo demand rose again in September, marking continued growth despite shifting trade routes and emerging headwinds from U.S. tariff changes, according to the International Air Transport Association (IATA).

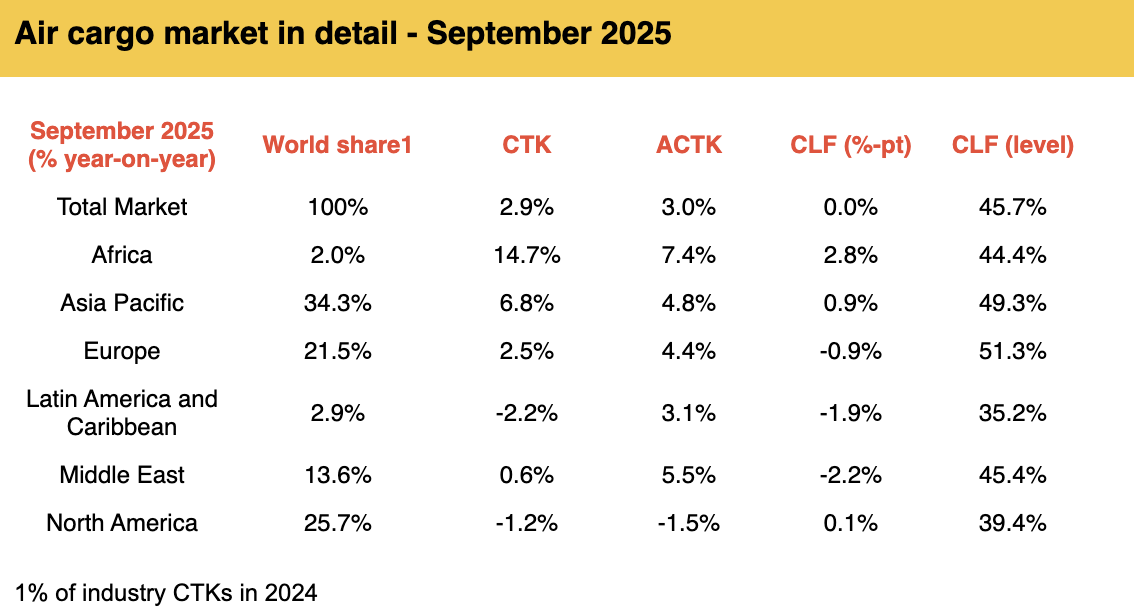

Total air cargo demand — measured in cargo tonne-kilometers (CTK) — rose by 2.9% compared to September 2024 levels. International operations saw a stronger 3.2%.

Cargo capacity increased by 3.0% compared to September 2024 and it was up 4.4% for international operations.

[Source: IATA]

In August, total air cargo demand increased 4.1% year over year. In July, total air cargo demand climbed 5.5% year-on-year and in June, global air cargo demand rose by 0.8% compared to June 2024. In May, it was up 2.2% compared to May 2024.

"Air cargo demand grew 2.9% year-on-year in September, marking the seventh consecutive month of overall growth. Buried in that growth is a significant alteration of trade patterns as US tariff policies, including the ending of de minimis exemptions, kick in," said Willie Walsh, director-general at IATA.

Walsh noted that on one side of the equation, a decline in North America-Asia demand has set in over the last five months. But this has been more than compensated for with strong growth within Asia and on routes linking Asia to Europe, Africa and the Middle East.

"While many had feared an unwinding of global trade, we are instead seeing air cargo adapting successfully to serve shifting market demands," IATA's director-general, added.

Africa, APAC airlines led regional performance

Africa and Asia led global air cargo growth in September, with African carriers posting a 14.7% year-on-year surge—the strongest of any region—while Asia-Pacific airlines saw demand climb 6.8%, according to the International Air Transport Association (IATA).

Capacity rose in both regions, up 7.4% in Africa and 4.8% in Asia-Pacific, underscoring continued momentum despite shifting trade patterns.

Elsewhere, growth was more subdued. Europe saw a 2.5% increase in demand, with capacity up 4.4%; Middle East carriers posted a modest 0.6% rise in demand, while capacity jumped 5.5%; North America recorded a 1.2% decline in demand and a 1.5% drop in capacity; and Latin America experienced the steepest slowdown, with demand falling 2.2% despite a 3.1% increase in capacity.

The uneven regional performance reflects broader shifts in global trade, as some cargo flows begin to divert away from North America amid evolving tariff policies, including the rollback of de minimis exemptions.

Air freight volumes in September 2025 increased across most major trade corridors. Europe-Asia and Within Asia posted robust double-digit growth, while Middle East-Asia, North America-Europe, and Africa-Asia also saw notable gains.

In contrast, Asia-North America, Middle East-Europe and Within Europe recorded declines.